Aging Population

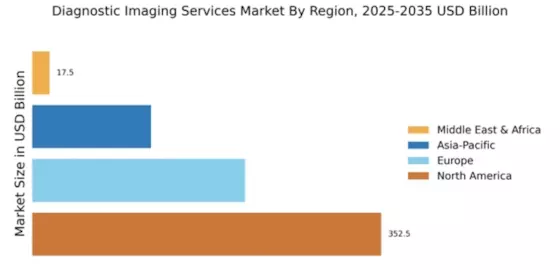

The Global Diagnostic Imaging Services Market Industry is also propelled by the aging population, which typically requires more frequent medical evaluations and imaging services. As individuals age, they are more susceptible to various health conditions that necessitate diagnostic imaging for accurate assessment and treatment. According to the United Nations, the global population aged 65 and older is expected to double by 2050, indicating a substantial increase in the demand for healthcare services, including diagnostic imaging. This demographic shift suggests a sustained growth trajectory for the market, as healthcare systems adapt to the needs of an older population, potentially reaching a market size of 60 USD Billion by 2035.

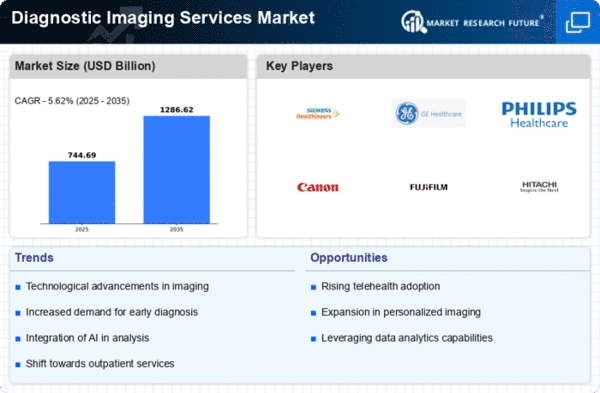

Market Growth Projections

The Global Diagnostic Imaging Services Market Industry is poised for substantial growth, with projections indicating a market size of 39.0 USD Billion in 2024 and an anticipated increase to 60 USD Billion by 2035. The compound annual growth rate of 4.01% from 2025 to 2035 suggests a steady expansion trajectory, driven by various factors such as technological advancements, increasing chronic disease prevalence, and an aging population. These growth projections highlight the potential for innovation and investment within the diagnostic imaging sector, as stakeholders seek to capitalize on emerging opportunities in this evolving landscape.

Technological Advancements

The Global Diagnostic Imaging Services Market Industry is experiencing rapid technological advancements, which enhance the accuracy and efficiency of imaging procedures. Innovations such as artificial intelligence and machine learning are being integrated into imaging systems, leading to improved diagnostic capabilities. For instance, AI algorithms can analyze imaging data more quickly than traditional methods, potentially reducing the time required for diagnosis. This trend is expected to drive the market's growth, with the industry projected to reach 39.0 USD Billion in 2024. As technology continues to evolve, it is likely that the market will see further enhancements in imaging modalities, thereby expanding its applications in various medical fields.

Rising Healthcare Expenditure

The Global Diagnostic Imaging Services Market Industry is positively impacted by the rising healthcare expenditure across various regions. Increased investment in healthcare infrastructure and technology is facilitating the adoption of advanced diagnostic imaging services. Governments and private sectors are allocating more funds to enhance healthcare facilities, which includes acquiring state-of-the-art imaging equipment. For instance, countries are witnessing a trend of increased healthcare budgets, which is likely to support the growth of the diagnostic imaging market. With a projected compound annual growth rate of 4.01% from 2025 to 2035, the market is expected to expand significantly, reaching 60 USD Billion by 2035.

Growing Demand for Preventive Healthcare

The Global Diagnostic Imaging Services Market Industry is experiencing a growing demand for preventive healthcare, which emphasizes early detection and intervention. Patients and healthcare providers are increasingly recognizing the importance of regular screenings and diagnostic imaging to identify health issues before they escalate. This trend is reflected in the rising number of imaging procedures performed annually, as more individuals seek preventive care. As awareness of preventive healthcare continues to grow, the market is likely to expand, with the industry projected to reach 39.0 USD Billion in 2024. This shift towards preventive measures may lead to a more proactive approach in healthcare, further driving the demand for diagnostic imaging services.

Increasing Prevalence of Chronic Diseases

The Global Diagnostic Imaging Services Market Industry is significantly influenced by the rising prevalence of chronic diseases, which necessitate advanced diagnostic tools for effective management. Conditions such as cardiovascular diseases, diabetes, and cancer are becoming more common, leading to a higher demand for imaging services. For example, the World Health Organization indicates that cancer cases are expected to rise by 70% over the next two decades. This growing patient population is likely to drive the market, with projections suggesting that the industry could reach 60 USD Billion by 2035. Consequently, healthcare providers are increasingly investing in diagnostic imaging technologies to meet this rising demand.