Rising Aging Population

The demographic shift towards an aging population in Italy appears to be a crucial driver for the diagnostic imaging-services market. As individuals age, the prevalence of chronic diseases and conditions requiring diagnostic imaging increases. According to recent statistics, approximately 23% of the Italian population is aged 65 and older, a figure projected to rise in the coming years. This demographic trend necessitates enhanced imaging services to facilitate early diagnosis and effective treatment. Consequently, healthcare providers are likely to invest in advanced imaging technologies to cater to the growing demand. The aging population's healthcare needs may drive innovation and expansion within the diagnostic imaging-services market, as facilities strive to improve patient outcomes and operational efficiency.

Rising Healthcare Expenditure

The increase in healthcare expenditure in Italy is likely to bolster the diagnostic imaging-services market. With the government allocating more funds to healthcare, there is a growing capacity for hospitals and clinics to invest in advanced imaging technologies. In 2025, healthcare spending in Italy is projected to reach €200 billion, reflecting a commitment to improving healthcare infrastructure. This financial support enables healthcare facilities to upgrade their imaging equipment and expand their service offerings. As a result, patients may have greater access to high-quality diagnostic imaging services, which could enhance overall healthcare delivery. The rising healthcare expenditure may thus serve as a catalyst for growth within the diagnostic imaging-services market.

Increased Focus on Early Diagnosis

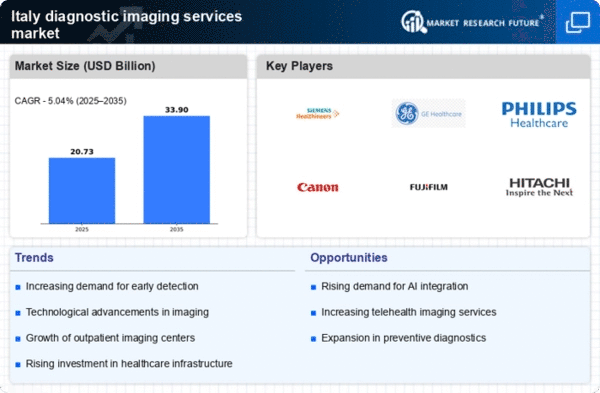

There is a growing emphasis on early diagnosis in Italy, which appears to be a significant driver for the diagnostic imaging-services market. Early detection of diseases, particularly cancers and cardiovascular conditions, can lead to better treatment outcomes and reduced healthcare costs. The Italian government has initiated various public health campaigns aimed at promoting regular screenings and check-ups, which may contribute to an increased demand for imaging services. Reports indicate that the market for diagnostic imaging is expected to grow at a CAGR of 5.5% over the next five years, driven by this focus on preventive care. As healthcare providers respond to this trend, investments in imaging technologies and services are likely to rise, further propelling the market forward.

Technological Integration in Healthcare

The integration of advanced technologies into healthcare systems in Italy is likely to significantly impact the diagnostic imaging-services market. Innovations such as artificial intelligence (AI) and machine learning are being increasingly adopted to enhance imaging accuracy and efficiency. For instance, AI algorithms can assist radiologists in interpreting images more quickly and accurately, potentially reducing diagnostic errors. The Italian healthcare sector has seen a surge in investments in digital health technologies, with spending on health IT projected to reach €3 billion by 2026. This technological integration not only improves patient care but also streamlines workflows, thereby increasing the overall capacity of diagnostic imaging services. As healthcare providers embrace these advancements, the diagnostic imaging-services market is expected to experience substantial growth.

Growing Public Awareness of Health Issues

The increasing public awareness of health issues in Italy appears to be a driving force for the diagnostic imaging-services market. As individuals become more informed about the importance of regular health check-ups and screenings, the demand for diagnostic imaging services is likely to rise. Educational initiatives and media campaigns have contributed to a heightened understanding of various health conditions, encouraging people to seek preventive care. This trend is reflected in the rising number of imaging procedures performed annually, which has increased by approximately 10% over the last five years. As public awareness continues to grow, healthcare providers may need to adapt their services to meet the evolving needs of the population, thereby fostering further growth in the diagnostic imaging-services market.