Market Growth Projections

The Global Plastic Pail Market Industry is projected to experience substantial growth over the coming years. The market is anticipated to reach 8.24 USD Billion in 2024 and is expected to grow to 12.1 USD Billion by 2035, indicating a robust trajectory. The compound annual growth rate (CAGR) of 3.52% from 2025 to 2035 suggests a steady increase in demand across various sectors, including food and beverage, chemicals, and industrial applications. This growth is likely to be driven by factors such as rising consumer preferences for durable packaging, sustainability initiatives, and technological advancements in manufacturing.

Rising Demand in Food and Beverage Sector

The Global Plastic Pail Market Industry experiences a notable surge in demand driven by the food and beverage sector. Plastic pails are increasingly utilized for packaging and transporting various food products, including sauces, dairy items, and snacks. This trend is partly attributed to the growing consumer preference for convenient and durable packaging solutions. As a result, the market is projected to reach 8.24 USD Billion in 2024, reflecting the industry's adaptability to consumer needs. Additionally, the emphasis on food safety and hygiene standards further propels the demand for plastic pails, making them a preferred choice for manufacturers in this sector.

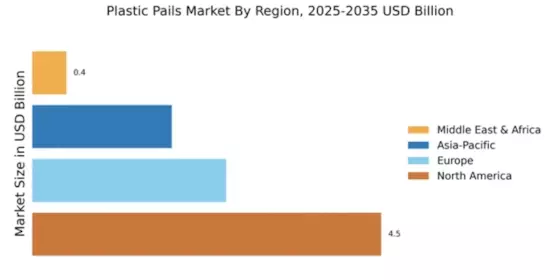

Emerging Markets and Global Trade Dynamics

The Global Plastic Pail Market Industry is significantly impacted by emerging markets and evolving global trade dynamics. Countries in Asia-Pacific and Latin America are witnessing rapid industrialization and urbanization, leading to increased demand for plastic pails across various sectors. Additionally, trade agreements and globalization facilitate the movement of goods, further boosting market growth. As these regions continue to develop, the demand for durable and cost-effective packaging solutions is expected to rise. This trend presents opportunities for manufacturers to expand their reach and capitalize on the growing market potential.

Technological Advancements in Manufacturing

Technological advancements play a pivotal role in shaping the Global Plastic Pail Market Industry. Innovations in manufacturing processes, such as injection molding and blow molding, enhance production efficiency and reduce costs. These advancements enable manufacturers to produce high-quality pails that meet diverse customer requirements. Furthermore, the introduction of automation and smart manufacturing technologies is expected to streamline operations and improve product consistency. As the industry adapts to these technological changes, it is likely to witness increased competitiveness and market expansion, contributing to the projected growth of 12.1 USD Billion by 2035.

Growth in Chemical and Industrial Applications

The Global Plastic Pail Market Industry is significantly influenced by the expansion of the chemical and industrial sectors. Plastic pails are extensively used for storing and transporting chemicals, paints, and industrial liquids due to their resistance to corrosion and leakage. The increasing production of chemicals and industrial goods globally contributes to the rising demand for these containers. With the market expected to grow at a CAGR of 3.52% from 2025 to 2035, the plastic pail's role in facilitating safe and efficient handling of hazardous materials becomes increasingly critical, thereby enhancing its market presence.

Sustainability Trends and Recycling Initiatives

Sustainability trends are reshaping the Global Plastic Pail Market Industry as manufacturers increasingly focus on eco-friendly practices. The push for recyclable and reusable packaging solutions is gaining traction, prompting companies to innovate in materials and designs. Many manufacturers are now producing pails from recycled plastics, aligning with global sustainability goals. This shift not only meets consumer demand for environmentally responsible products but also helps reduce the carbon footprint associated with plastic production. As the market evolves, the integration of sustainable practices is likely to enhance the appeal of plastic pails, potentially driving further growth.