North America : Innovation and Sustainability Focus

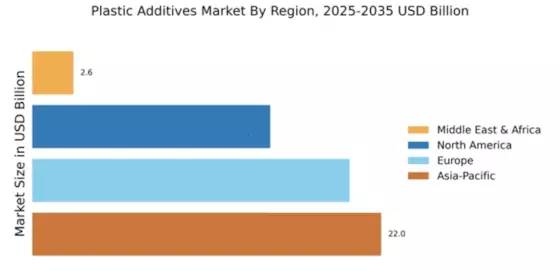

The North American plastic additives market is projected to reach $15.0 billion by 2025, driven by increasing demand for sustainable and innovative materials. Regulatory initiatives aimed at reducing environmental impact are catalyzing growth, with a focus on bio-based additives and recycling technologies. The region's strong manufacturing base and technological advancements further support this trend, making it a key player in the global market. Leading countries such as the US and Canada dominate the North American market, with major companies like DuPont and BASF SE driving innovation. The competitive landscape is characterized by a mix of established players and emerging startups, all vying for market share. The presence of key players ensures a robust supply chain, while ongoing investments in R&D are expected to enhance product offerings and meet evolving consumer demands.

Europe : Regulatory Compliance and Innovation

Europe's plastic additives market is anticipated to grow to $20.0 billion by 2025, fueled by stringent regulations and a strong push for sustainability. The European Union's directives on plastic waste management and recycling are significant drivers, encouraging the adoption of eco-friendly additives. This regulatory landscape not only shapes market dynamics but also fosters innovation in product development, aligning with consumer preferences for sustainable solutions. Germany, France, and the UK are leading countries in this market, with companies like Clariant AG and Evonik Industries AG at the forefront. The competitive environment is marked by a focus on high-performance additives that comply with environmental standards. The presence of established players, along with a growing number of startups, enhances the region's innovation capabilities, ensuring a diverse range of products to meet market demands.

Asia-Pacific : Emerging Powerhouse in Additives

The Asia-Pacific region is set to dominate the plastic additives market, with a projected size of $22.0 billion by 2025. Rapid industrialization, urbanization, and increasing consumer demand for plastics are key growth drivers. Additionally, government initiatives promoting manufacturing and exports are catalyzing market expansion. The region's focus on innovation and sustainability is also shaping the future of plastic additives, aligning with global trends towards eco-friendly solutions. China, Japan, and India are the leading countries in this market, with significant contributions from major players like SABIC and Mitsubishi Chemical Corporation. The competitive landscape is characterized by a mix of local and international companies, all striving to capture market share. Investments in R&D and strategic partnerships are common, as companies aim to develop advanced additives that meet the diverse needs of various industries.

Middle East and Africa : Resource-Rich Frontier

The Middle East and Africa plastic additives market is projected to reach $2.59 billion by 2025, driven by increasing demand in construction, automotive, and packaging sectors. The region's rich natural resources and growing manufacturing capabilities are significant growth drivers. Additionally, government initiatives aimed at diversifying economies and promoting industrialization are expected to further boost market development, creating opportunities for innovative additive solutions. Countries like Saudi Arabia and South Africa are leading the market, with a growing presence of key players such as LANXESS AG and A. Schulman, Inc. The competitive landscape is evolving, with both local and international companies vying for market share. The focus on sustainability and compliance with international standards is becoming increasingly important, shaping the future of the plastic additives market in this region.