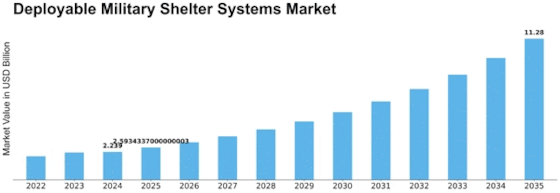

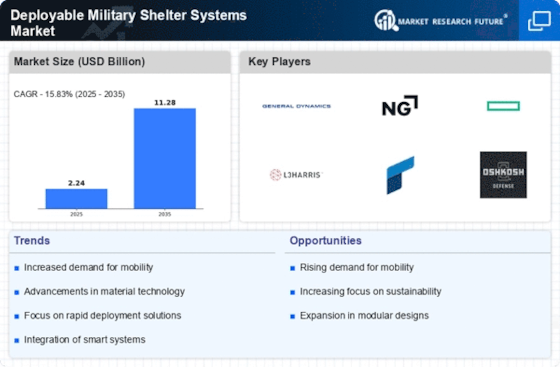

Deployable Military Shelter Systems Size

Deployable Military Shelter Systems Market Growth Projections and Opportunities

The deployable military shelter systems market is influenced by several key factors that drive its growth and development. Deployable military shelter systems are essential components of military operations, providing temporary housing, workspace, and storage facilities for personnel, equipment, and supplies in various operational environments. One of the primary drivers of the deployable military shelter systems market is the increasing demand for rapid deployment and mobility in modern military operations. As military forces face diverse and dynamic threats worldwide, there's a growing need for deployable shelters that can be quickly erected, transported, and reconfigured to support mission-critical activities such as command posts, field hospitals, and logistics hubs.

Moreover, advancements in shelter technology, including developments in lightweight materials, modular construction, and rapid deployment mechanisms, have led to innovations in deployable military shelter systems, driving further adoption across military organizations worldwide. New generations of shelter systems offer features such as quick assembly, collapsible frames, weather-resistant fabrics, and insulation capabilities, enabling soldiers to establish operational bases and facilities in remote and challenging environments with minimal time and effort. This drives demand for deployable military shelter systems that offer enhanced mobility, durability, and functionality to support a wide range of mission requirements and operational scenarios.

Furthermore, the growing trend towards expeditionary warfare and expeditionary logistics is driving investment and innovation in deployable military shelter systems. Military forces are increasingly adopting expeditionary operating concepts and agile logistics practices to enhance responsiveness, flexibility, and sustainability in expeditionary operations. Deployable shelter systems play a crucial role in expeditionary logistics by providing mobile and scalable infrastructure for sustainment, resupply, and support functions in forward operating areas, remote outposts, and austere environments. This creates opportunities for shelter system manufacturers to develop integrated solutions that streamline logistics operations and enhance expeditionary capabilities for military forces worldwide.

Additionally, the increasing emphasis on force protection, survivability, and resilience in military operations is driving demand for deployable military shelter systems that offer enhanced protection against ballistic threats, blast effects, and environmental hazards. Military forces require shelter systems that provide secure and fortified enclosures for personnel and equipment, reducing vulnerability to enemy attacks, natural disasters, and adverse weather conditions. Deployable shelters with integrated armor panels, blast-resistant construction, and chemical, biological, radiological, and nuclear (CBRN) protection capabilities enhance the safety and security of deployed personnel and assets, enabling military forces to maintain operational readiness and mission effectiveness in hostile environments.

Moreover, the growing demand for expeditionary infrastructure in disaster relief, humanitarian assistance, and emergency response missions is driving growth in the deployable military shelter systems market. Military forces are often called upon to provide rapid assistance and support in response to natural disasters, humanitarian crises, and other emergencies around the world. Deployable shelters play a critical role in disaster response operations by providing temporary housing, medical facilities, command centers, and logistics support to affected populations and relief workers. This creates opportunities for shelter system manufacturers to collaborate with government agencies, humanitarian organizations, and disaster response teams to develop specialized solutions tailored to the needs of emergency response and disaster relief missions.

Leave a Comment