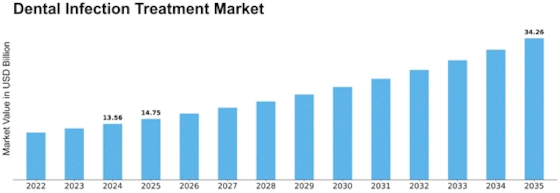

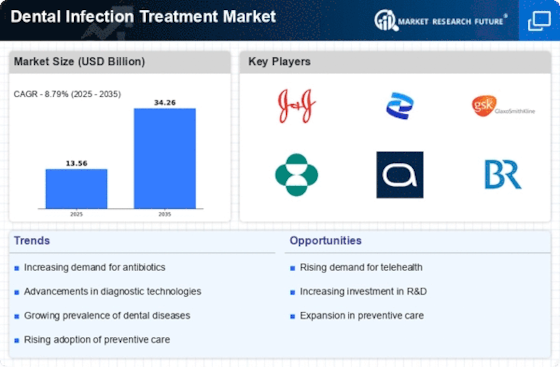

Dental Infection Treatment Size

Dental Infection Treatment Market Growth Projections and Opportunities

The dynamics and growth trajectory of the Dental Infection Treatment Market are influenced by numerous factors. Among the key market drivers is the burgeoning incidence of dental infections across all regions globally. As awareness for oral health increases, more people are accessing dental services thereby creating a demand for infection treatment. Furthermore, the aging populace in developed regions also contributes to expanding the market. With age, people become more susceptible to dental infections thus necessitating efficient treatment methods.

Technological advancements in dentistry are equally instrumentalized in determining the shape of this market. Innovations in diagnostic tools, treatment modalities and materials have improved upon efficacy of dental infection treatments hence promoting market growth. Moreover, digital technologies such as 3D imaging and computer-aided design and manufacturing have revolutionized dentistry leading to precise and efficient solutions for infection treatment.

The Dental Infection Treatment Market is considerably influenced by regulatory environment and reimbursement policies. Stringent regulations are put in place to enhance safety and efficiency of dental products as well as treatments that affect entry into the market whenever new solutions emerge. Reimbursement policy both public and private play a significant role when it comes to accessibility of dental infection treatments thus affecting market penetration as well as adoption rates.

Market competition is another factor that significantly affects consolidation within the Dental Infection Treatment Market. There exist several key players on this industry; from pharmaceutical companies supplying antibiotics to manufacturers who produce innovative therapies through device technology. Dental acquisitions therefore lead to industry consolidation which would impact upon competitive dynamics while redistributing market shares too.

Consumer choices & habits contribute to these factors of the Dental Infection Treatment Market’s own marketing mix too. This means that faster recovery times coupled with minimal invasive procedures hence a preference for better treatments lead patients into advanced options where quickest possible solution can be discovered upon complication arising due untreated dental infections which will result into higher sales recorded.

The Dental Infection Treatment Market can experience massive fluctuations depending on economic factors such as healthcare expenditure and insurance coverage. The levels of healthcare spending within a region determine the affordability and accessibility of dental care, which ultimately affects market demand. Moreover, dental procedures are covered by insurance policies which serve as deciding factor for patients in making choices regarding the treatment process.

The Dental Infection Treatment Market has been influenced by global health crises, such as the COVID-19 pandemic, in ways never seen before. These events have affected market dynamics through supply chain disruptions, changes in consumer priorities and shifts in healthcare infrastructure. On the other hand though, the pandemic has enabled faster adoption of telehealth and digital solutions in dentistry that present new opportunities for incumbents.”

Leave a Comment