North America : Market Leader in Cyber Defense

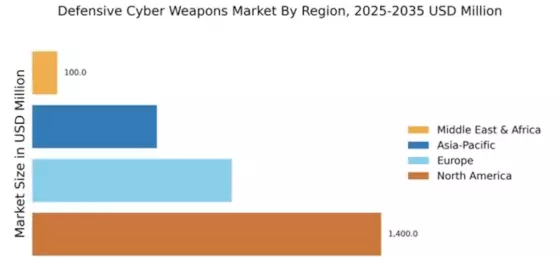

North America continues to lead the Defensive Cyber Weapons market, holding a significant share of 1400.0M in 2024. The region's growth is driven by increasing cyber threats, government investments in cybersecurity, and stringent regulations aimed at protecting critical infrastructure. The demand for advanced cyber defense technologies is further fueled by the rising adoption of cloud services and IoT devices, necessitating robust security measures.

The competitive landscape in North America is characterized by the presence of major players such as Raytheon Technologies, Northrop Grumman, and Lockheed Martin. These companies are at the forefront of innovation, developing cutting-edge solutions to counteract evolving cyber threats. The U.S. government plays a pivotal role in shaping the market through initiatives and funding aimed at enhancing national security, ensuring that the region remains a powerhouse in cyber defense capabilities.

Europe : Emerging Cybersecurity Hub

Europe is witnessing a growing demand for Defensive Cyber Weapons, with a market size of 800.0M in 2024. The region's growth is propelled by increasing regulatory requirements, such as the EU's General Data Protection Regulation (GDPR), which mandates stringent data protection measures. Additionally, the rise in cyberattacks on critical infrastructure has led to heightened awareness and investment in cybersecurity solutions across various sectors.

Leading countries in Europe, such as the UK, France, and Germany, are home to key players like BAE Systems and Thales Group, who are actively developing innovative cyber defense technologies. The competitive landscape is evolving, with a focus on collaboration between government and private sectors to enhance cybersecurity resilience. As Europe strengthens its cyber defense posture, it is positioning itself as a significant player in the global market.

Asia-Pacific : Growing Demand for Cyber Solutions

The Asia-Pacific region is rapidly emerging in the Defensive Cyber Weapons market, with a market size of 500.0M in 2024. The growth is driven by increasing digitalization, rising cyber threats, and government initiatives aimed at bolstering national security. Countries in this region are investing heavily in cybersecurity infrastructure, recognizing the need to protect sensitive data and critical systems from cyberattacks.

Key players in the Asia-Pacific market include local firms and international companies expanding their footprint. Countries like Japan, Australia, and India are leading the charge, with significant investments in cyber defense technologies. The competitive landscape is characterized by a mix of established players and startups, fostering innovation and collaboration to address the unique cybersecurity challenges faced in the region.

Middle East and Africa : Emerging Cybersecurity Landscape

The Middle East and Africa region is gradually developing its Defensive Cyber Weapons market, with a size of 100.0M in 2024. The growth is primarily driven by increasing awareness of cyber threats and the need for enhanced security measures across various sectors, including finance and government. Regulatory frameworks are being established to guide investments in cybersecurity, reflecting a commitment to safeguarding national interests.

Countries like the UAE and South Africa are at the forefront of this emerging market, with government initiatives aimed at strengthening cyber defense capabilities. The presence of key players is growing, as international firms recognize the potential in this region. As investments in cybersecurity infrastructure increase, the Middle East and Africa are positioning themselves as a vital area for future growth in the cyber defense sector.