Increased Military Expenditure

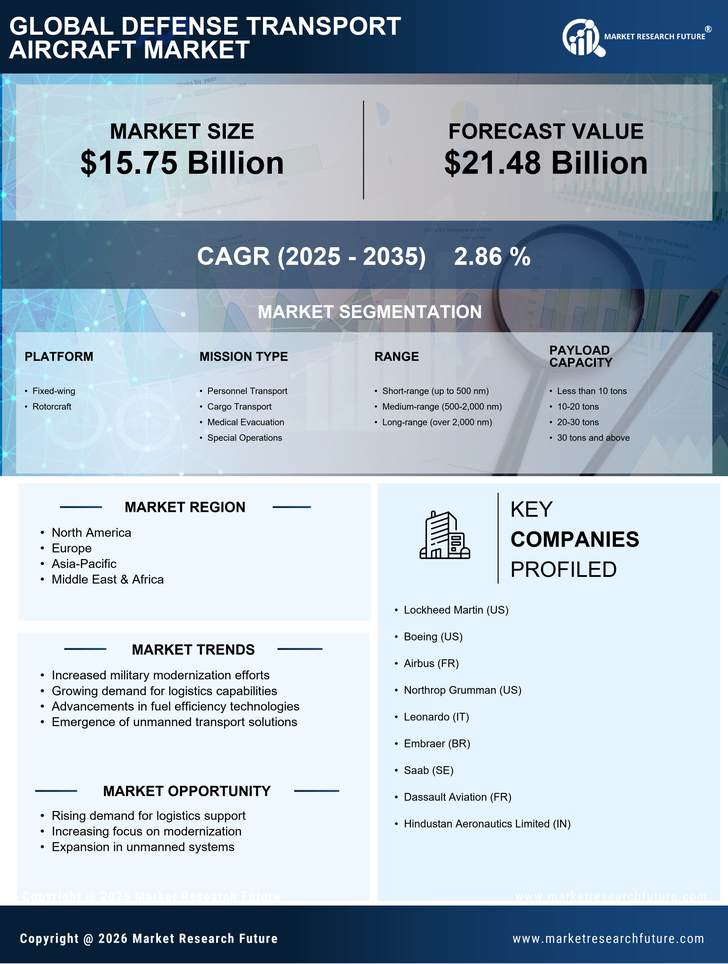

The defense Transport Aircraft Market is experiencing a notable surge in military expenditure across various nations. Governments are prioritizing defense budgets to enhance their military capabilities, which includes the procurement of advanced transport aircraft. For instance, recent data indicates that military spending has increased by approximately 3.5% annually, reflecting a growing recognition of the need for robust logistical support in military operations. This trend is likely to drive demand for transport aircraft, as nations seek to modernize their fleets and ensure operational readiness. The emphasis on strategic airlift capabilities further underscores the importance of investing in advanced transport solutions, thereby propelling the Defense Transport Aircraft Market forward.

Emerging Threats and Security Challenges

The Defense Transport Aircraft Market is significantly influenced by the emergence of new security challenges and threats. As geopolitical tensions rise, nations are compelled to enhance their military readiness, which includes the need for efficient transport solutions. The increasing frequency of humanitarian missions and disaster relief operations also necessitates a reliable transport aircraft fleet. Data suggests that the demand for transport aircraft is projected to grow by 4% annually, driven by the need for rapid deployment capabilities in response to crises. This evolving security landscape is likely to stimulate investments in the Defense Transport Aircraft Market, as countries strive to adapt to changing operational requirements.

Strategic Partnerships and Collaborations

The Defense Transport Aircraft Market is benefiting from strategic partnerships and collaborations among defense contractors and governments. These alliances facilitate knowledge sharing and resource pooling, leading to the development of advanced transport solutions. Joint ventures between nations and defense firms are becoming increasingly common, as they allow for the sharing of costs and risks associated with aircraft development. Recent collaborations have resulted in the successful launch of next-generation transport aircraft, which are designed to meet the evolving needs of military operations. This trend is likely to enhance the competitiveness of the Defense Transport Aircraft Market, as companies strive to innovate and deliver superior products.

Technological Innovations in Aircraft Design

Technological innovations are reshaping the Defense Transport Aircraft Market, leading to the development of more efficient and capable aircraft. Advancements in materials, avionics, and propulsion systems are enhancing the performance and operational efficiency of transport aircraft. For example, the integration of advanced composite materials is reducing weight while improving fuel efficiency, which is crucial for long-range missions. The market is witnessing a shift towards multi-role aircraft that can perform various functions, thereby increasing their utility. As nations seek to leverage these technological advancements, the Defense Transport Aircraft Market is poised for growth, with investments in research and development becoming a priority.

Focus on Logistics and Supply Chain Efficiency

The Defense Transport Aircraft Market is increasingly focused on enhancing logistics and supply chain efficiency. As military operations become more complex, the need for effective transport solutions is paramount. Efficient logistics systems are essential for ensuring timely delivery of personnel and equipment to operational theaters. Data indicates that investments in logistics capabilities are expected to grow by 5% annually, reflecting the importance of optimizing supply chains. The integration of advanced transport aircraft into logistics operations is likely to improve overall mission effectiveness. Consequently, the Defense Transport Aircraft Market is positioned to thrive as nations prioritize logistics efficiency in their defense strategies.