Regulatory Developments

The Decentralized Insurance Market is influenced by evolving regulatory frameworks that aim to accommodate innovative insurance models. Governments and regulatory bodies are increasingly recognizing the potential of decentralized solutions to enhance consumer protection and market efficiency. Recent initiatives in various jurisdictions have begun to establish guidelines for blockchain-based insurance products, which could foster growth in this sector. For instance, regulatory clarity may encourage investment and innovation, as companies feel more secure in developing decentralized offerings. This regulatory evolution appears to be a critical driver, as it could facilitate broader acceptance and integration of decentralized insurance solutions.

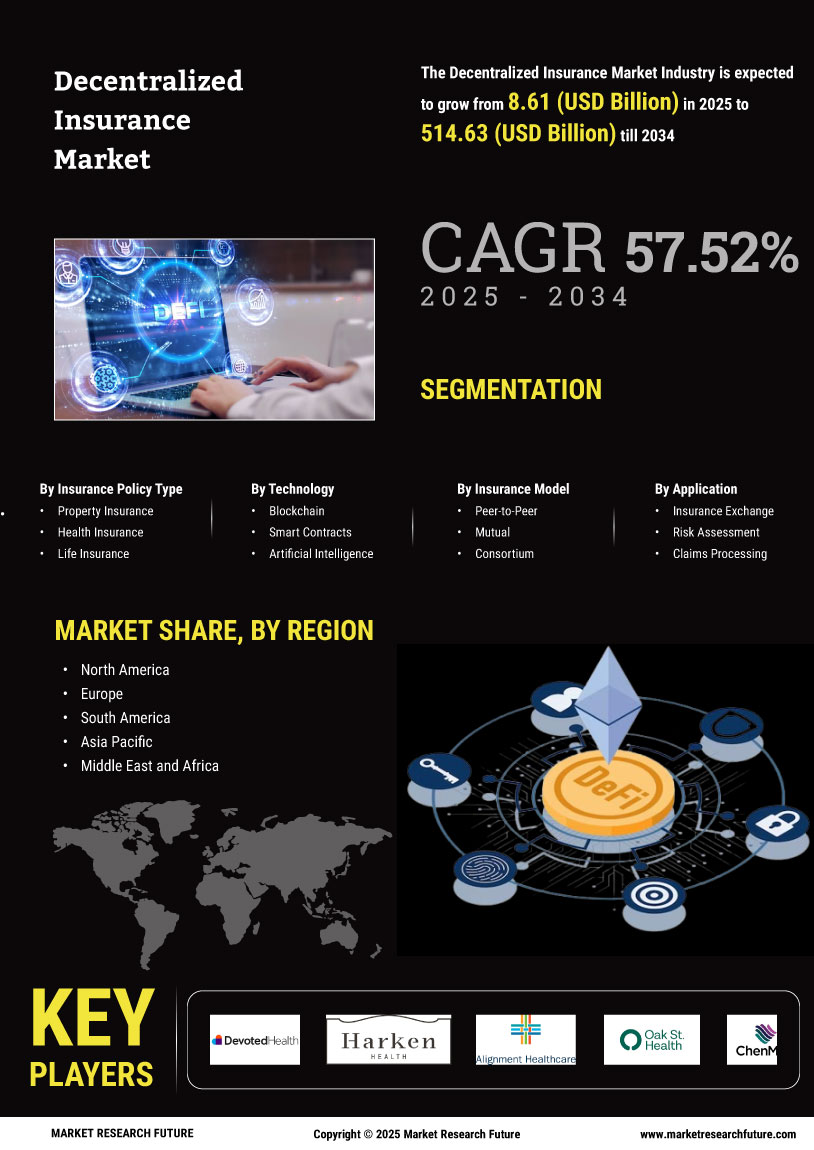

Rise of Smart Contracts

The Decentralized Insurance Market is witnessing a notable rise in the adoption of smart contracts, which automate and enforce agreements without the need for intermediaries. This technology enhances transparency and reduces operational costs, as claims can be processed automatically based on predefined conditions. According to recent estimates, the use of smart contracts in insurance could reduce administrative costs by up to 30%. As more companies integrate these contracts into their offerings, the efficiency and reliability of decentralized insurance solutions are likely to improve, attracting a broader customer base. This trend indicates a shift towards more streamlined processes, which could redefine traditional insurance paradigms.

Increased Consumer Awareness

Consumer awareness regarding decentralized insurance solutions is on the rise, significantly impacting the Decentralized Insurance Market. As individuals become more educated about blockchain technology and its applications in insurance, they are more likely to seek out decentralized options. This shift in consumer behavior is supported by a growing number of educational resources and platforms that explain the benefits of decentralized insurance, such as lower costs and enhanced security. Market surveys indicate that nearly 60% of consumers are now familiar with decentralized insurance concepts, suggesting a potential increase in demand for these innovative products. This heightened awareness could drive market growth as consumers actively seek alternatives to traditional insurance.

Growing Demand for Transparency

In the Decentralized Insurance Market, there is an increasing demand for transparency among consumers. Traditional insurance models often suffer from a lack of clarity regarding policy terms and claims processes. Decentralized insurance, leveraging blockchain technology, offers a transparent framework where all transactions are recorded and accessible. This transparency not only builds trust but also empowers consumers to make informed decisions. Market data suggests that approximately 70% of consumers prefer insurance solutions that provide clear visibility into policy details and claims handling. As this demand continues to rise, companies that prioritize transparency are likely to gain a competitive edge.

Technological Advancements in Risk Assessment

Technological advancements in risk assessment are transforming the Decentralized Insurance Market. Innovations such as artificial intelligence and big data analytics are enabling insurers to evaluate risks more accurately and efficiently. These technologies allow for personalized insurance products tailored to individual needs, which is a departure from the one-size-fits-all approach of traditional insurance. As a result, decentralized insurance providers can offer more competitive pricing and better coverage options. Market analysis indicates that the integration of advanced risk assessment tools could lead to a 20% increase in customer satisfaction, as clients receive more relevant and fair pricing based on their unique risk profiles. This trend is likely to enhance the appeal of decentralized insurance solutions.