Increasing Data Center Consolidation

The trend of data center consolidation is a pivotal driver in the Datacenter Blade Server Market. Organizations are increasingly seeking to optimize their IT infrastructure by consolidating multiple servers into fewer, more efficient blade servers. This consolidation not only reduces physical space requirements but also enhances energy efficiency and lowers operational costs. According to recent data, the average data center is expected to reduce its physical footprint by up to 30% through the adoption of blade server technology. As enterprises strive for streamlined operations, the demand for blade servers is likely to surge, thereby propelling growth in the Datacenter Blade Server Market.

Demand for Enhanced Security Features

As cyber threats continue to evolve, the demand for enhanced security features in data centers is becoming a significant driver in the Datacenter Blade Server Market. Organizations are prioritizing the protection of sensitive data and are seeking blade servers that offer advanced security capabilities. Features such as secure boot, hardware-based encryption, and integrated security management are increasingly being integrated into blade server designs. Market analysis reveals that the security segment of the IT infrastructure is expected to grow substantially, with organizations willing to invest in secure blade server solutions. This trend is likely to bolster the Datacenter Blade Server Market as companies strive to safeguard their data assets.

Shift Towards Cloud Computing Solutions

The ongoing shift towards cloud computing solutions is a transformative driver in the Datacenter Blade Server Market. As businesses increasingly migrate their operations to the cloud, the demand for efficient and scalable server solutions rises. Blade servers, with their ability to support cloud environments effectively, are becoming a preferred choice for data centers. Market data indicates that the cloud services market is projected to expand significantly, with many organizations opting for blade servers to enhance their cloud infrastructure. This shift not only supports the growth of the Datacenter Blade Server Market but also encourages innovation in server technology to meet evolving cloud demands.

Growing Need for High-Performance Computing

The escalating demand for high-performance computing (HPC) solutions is significantly influencing the Datacenter Blade Server Market. Industries such as finance, healthcare, and scientific research require robust computing power to process vast amounts of data efficiently. Blade servers, known for their superior performance and scalability, are increasingly being deployed to meet these needs. Market data indicates that the HPC segment is projected to grow at a compound annual growth rate of over 10% in the coming years. This growth is likely to drive the adoption of blade servers, as organizations seek to enhance their computational capabilities within the Datacenter Blade Server Market.

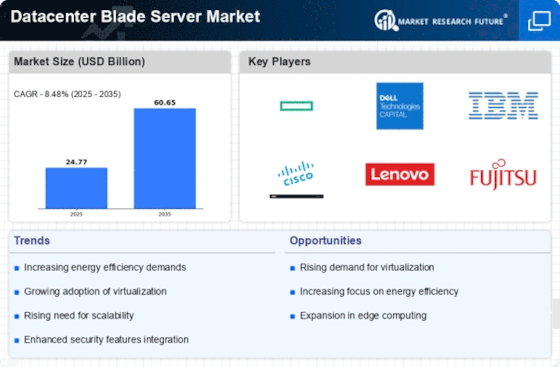

Rising Adoption of Virtualization Technologies

The adoption of virtualization technologies is a crucial factor driving the Datacenter Blade Server Market. Virtualization allows multiple virtual machines to run on a single physical server, maximizing resource utilization and reducing costs. Blade servers are particularly well-suited for virtualization due to their compact design and efficient resource management. As organizations increasingly implement virtualization strategies to enhance operational efficiency, the demand for blade servers is expected to rise. Recent statistics suggest that over 70% of enterprises are utilizing some form of virtualization, indicating a robust market for blade servers within the Datacenter Blade Server Market.