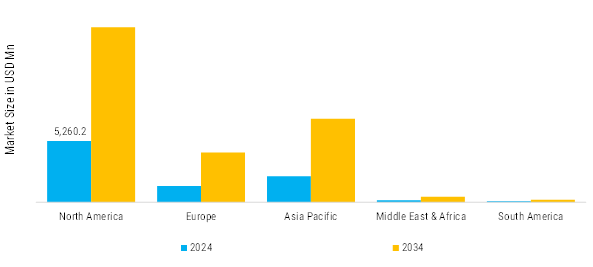

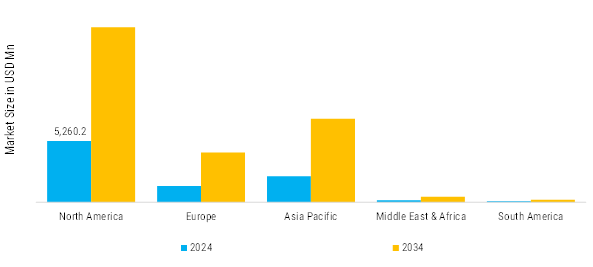

Based on region, the Global Aircraft Video Surveillance Market is segmented into North America, Europe, Asia-Pacific, South America and Middle East and Africa. North America accounted for the largest market share in 2024 and is anticipated to reach USD 14,990.7 Million by 2034. Asia-Pacific is projected to grow at the highest CAGR of 10.9% during the forecast period.

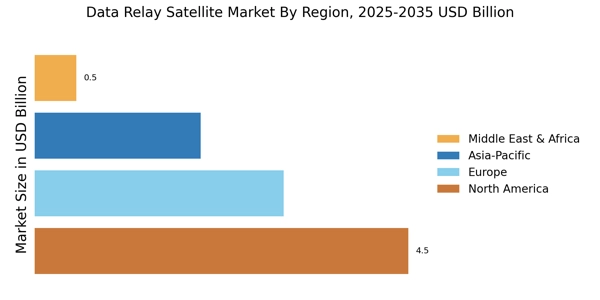

North America: World technology leader and the largest addressable market of DRS capabilities.

The market for data relay satellite has highest market share in North America, The world technology leader and the largest addressable market of DRS capabilities is North America which is a combination of the legacy government assets, refined industry supply chains along with fast-developing commercial DRaaS enterprises. On its end, the TDRSS legacy creates a technical reference point on which NASA can benchmark future GEO-based relay services with near-continuous coverage applied to human spaceflight, planetary science missions, and other high-priority civil science platforms; even more, its architecture and operating policies shape government program procurements and interoperability needs. Labs and research firms uncertain how to continue in the commercialization direction are rushing to join the rush of commercial entities in adapting dedicated relay constellations, hosted payload structures, and hybrid RF/optical gateway networks to pursue high-frequency Earth observation (EO) missions and tactical defense applications. Among its noteworthy advantages are the mature presence of high-quality integrators (Lockheed Martin, Northrop Grumman, Boeing) and developers of the LCT/ISL technology and the close access to tier-1 launch providers that further minimizes the mission cycle time and provides the flexibility in the GTO/GEO insertion profiles.

Operationally, North America focuses on regenerative payload designs, onboard, packet switching and hard crypto stacks to MIL-SPEC clients - touring need of raptor-proofed processors, GaN amplifiers andAbout robust thermal control. The ground segment is moving to cloud-native mission operations, software-defined networking (SDN) satellite gateway-to cloud (G2C) interconnection, and distributed optical ground-station (OGS) farms to overcome link-loss insertion caused by weather. Such considerations as regulatory and policy, including ITAR, EAR, DoD acquisition structures, sourcing, JV structures, and export compliance costs, are shaped by regulatory and policy; long-term demand is supported by federal R&D incentive programs and the defense modernization effort. Risks are the concentrated supplier base of flight-proven LCT and long procurement cycles; opportunities reside in the ability of edge processing to enable relay services and monetization of hosted payloads and integration of quantum-safe encryption on high-security relays.

Europe: Secure and autonomous space networks

The market of data relay satellite in Europe is motivated by the rising investments in the space-based communication system and emphasis on the capabilities of the independent and secure data transmission. Strategic value of the region in real-time data relay of the Earth observation missions, environmental monitoring and defense applications. The increasing involvement in collaborative space programs, and continuous improvement of satellite infrastructure are aiding in the growth of the market. Also, the change in laser communication technologies and the growing need to deliver data with low latency is also increasing the use of data relay satellites in European countries.

Asia-pacific: Expanding space program investments

Asia Pacific is becoming a high-growth market in data relay satellite because of growing space programs, growing satellite launches and demand of high-speed communication network. The governments of the area are putting a lot of investment in Earth observation, navigation, and defense space missions, and thus necessitate the need to have good data relay abilities. Furthermore, the blistering development of technologies, the expansion of indigenous satellite production, and the increased interest in space-based connectivity are also leading to a good momentum in the market in the region.

South America: Improving satellite connectivity

The market of data relay satellite in South America is expanding steadily, and it is being backed by the rising need to have better communication coverage, Earth monitoring, and disaster management. A number of nations are committing to satellite-based technologies to improve connectivity in the remote and underserved regions. Whereas space programs are not large scale, regional cooperation and alliances are facilitating access to data relay services. Also, the increasing attention to the environmental monitoring and the need to develop infrastructure is slowly contributing to the market growth.

Middle-East & Africa: Strategic satellite communication growth

There is an increase in the use of the data relay satellite system in the Middle East and Africa region with the rising investments in the space programs, military communication programs, and national connectivity programs. The desire is being fueled by strategic emphasis on improvement of secure communication links, remote surveillance support, and broadband coverage. Moreover, the increased interest in creating capabilities to develop domestic space and build more satellite ground infrastructure is contributing to growth in the long term. Market potential in the area is further enhanced by the necessity to have effective communication over large and inaccessible distances.