Emergence of Big Data Technologies

The Data Preparation Tool Market is significantly influenced by the emergence of big data technologies. As organizations generate and collect vast amounts of data, the need for efficient data preparation tools becomes paramount. These tools facilitate the cleaning, transformation, and integration of data from diverse sources, ensuring that businesses can effectively utilize big data for analytics. The market is expected to expand as companies seek solutions that can handle the complexities associated with big data. Furthermore, the integration of machine learning and artificial intelligence into data preparation tools is anticipated to enhance their capabilities, making them indispensable in the Data Preparation Tool Market. This trend suggests that organizations are not only looking for tools to manage data but also for those that can provide intelligent insights and automation.

Integration with Cloud-Based Solutions

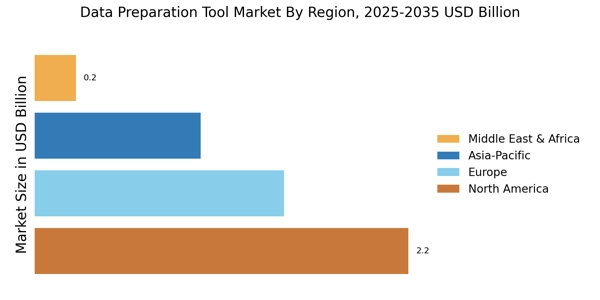

The Data Preparation Tool Market is witnessing a significant shift towards cloud-based solutions. As organizations increasingly migrate their operations to the cloud, the demand for data preparation tools that seamlessly integrate with cloud platforms is on the rise. Cloud-based data preparation tools offer scalability, flexibility, and cost-effectiveness, making them attractive options for businesses of all sizes. This trend is likely to accelerate as companies seek to leverage the benefits of cloud computing, such as enhanced collaboration and accessibility. Furthermore, the integration of data preparation tools with cloud services can streamline workflows and improve data accessibility, thereby enhancing the overall efficiency of data analytics processes within the Data Preparation Tool Market.

Rising Demand for Data-Driven Decision Making

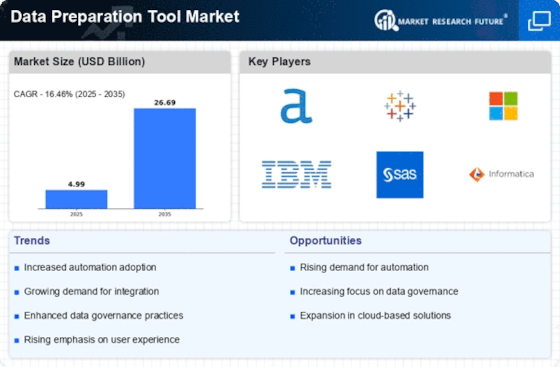

The Data Preparation Tool Market experiences a notable surge in demand as organizations increasingly recognize the value of data-driven decision making. Companies are investing in data preparation tools to enhance their analytical capabilities, enabling them to derive actionable insights from vast datasets. According to recent estimates, the market for data preparation tools is projected to grow at a compound annual growth rate of approximately 20% over the next five years. This growth is driven by the need for businesses to remain competitive in an increasingly data-centric environment. As organizations strive to leverage data for strategic advantages, the Data Preparation Tool Market is likely to witness a significant uptick in adoption rates, particularly among small and medium-sized enterprises that are beginning to harness the power of data analytics.

Advancements in Data Visualization Technologies

The Data Preparation Tool Market is also being shaped by advancements in data visualization technologies. As organizations strive to present data in more intuitive and engaging formats, the need for data preparation tools that support effective visualization becomes increasingly critical. These tools enable users to transform raw data into visually appealing dashboards and reports, facilitating better understanding and communication of insights. The market is likely to see a rise in demand for data preparation tools that offer advanced visualization capabilities, as businesses recognize the importance of storytelling with data. This trend suggests that the Data Preparation Tool Market will continue to evolve, with a focus on enhancing user experience and enabling more effective data-driven narratives.

Growing Emphasis on Data Governance and Compliance

In the Data Preparation Tool Market, there is a growing emphasis on data governance and compliance. Organizations are increasingly aware of the importance of adhering to regulations such as GDPR and CCPA, which necessitate robust data management practices. Data preparation tools play a crucial role in ensuring that data is accurate, consistent, and compliant with legal standards. As businesses face heightened scrutiny regarding data privacy and security, the demand for tools that facilitate effective data governance is likely to rise. This trend is expected to drive innovation within the Data Preparation Tool Market, as vendors develop solutions that not only streamline data preparation processes but also incorporate features that support compliance and governance initiatives.