Expansion of the Biofuel Sector

The expansion of the biofuel sector plays a crucial role in the Global Carbohydrate Enzyme Preparation Market Industry. As countries strive to reduce carbon emissions and transition to renewable energy sources, the demand for biofuels derived from carbohydrates is increasing. Carbohydrate enzymes are essential in the conversion of biomass into fermentable sugars, which are then transformed into biofuels. This growing emphasis on sustainable energy solutions is expected to propel the market forward, as industries seek efficient enzyme preparations to optimize biofuel production processes. The synergy between biofuel development and enzyme technology could lead to significant market growth in the coming years.

Rising Demand for Processed Foods

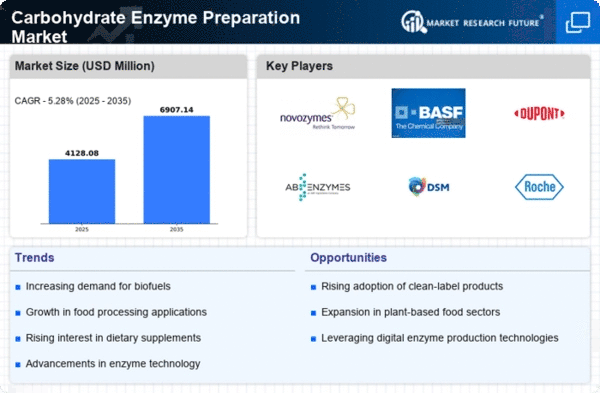

The Global Carbohydrate Enzyme Preparation Market Industry experiences a surge in demand for processed foods, driven by changing consumer lifestyles and preferences. As urbanization increases, more consumers seek convenient meal options, leading to a higher utilization of carbohydrate enzymes in food production. These enzymes enhance the texture, flavor, and shelf-life of products, making them more appealing. In 2024, the market is projected to reach 3.92 USD Billion, reflecting the growing reliance on enzyme preparations to meet the needs of the processed food sector. This trend is expected to continue, with the market potentially expanding as consumer preferences evolve.

Growing Awareness of Health Benefits

The Global Carbohydrate Enzyme Preparation Market Industry benefits from an increasing awareness of health benefits associated with carbohydrate enzymes. Consumers are becoming more informed about the role of enzymes in digestion and overall health, leading to a rise in demand for enzyme-based dietary supplements and functional foods. This trend is particularly evident in regions with a high prevalence of digestive disorders, where enzyme preparations are marketed as solutions for improving gut health. As the global population continues to prioritize health and wellness, the market for carbohydrate enzyme preparations is likely to expand, driven by consumer education and demand for health-oriented products.

Regulatory Support for Enzyme Applications

Regulatory support for enzyme applications significantly impacts the Global Carbohydrate Enzyme Preparation Market Industry. Governments worldwide are increasingly recognizing the benefits of enzyme technologies in various sectors, including food, agriculture, and biofuels. This recognition often translates into favorable regulations and incentives that encourage the use of carbohydrate enzymes. For instance, policies promoting sustainable agricultural practices and food safety standards may drive the adoption of enzyme preparations in these industries. As regulatory frameworks evolve to support innovation and sustainability, the market is likely to witness accelerated growth, fostering a conducive environment for enzyme manufacturers.

Technological Advancements in Enzyme Production

Technological innovations in enzyme production significantly influence the Global Carbohydrate Enzyme Preparation Market Industry. Advances in biotechnology and fermentation processes enhance the efficiency and yield of enzyme production, allowing manufacturers to meet increasing global demand. These improvements not only reduce production costs but also lead to the development of more effective enzyme formulations. As a result, companies are likely to invest in research and development to create novel carbohydrate enzymes tailored for specific applications. This focus on innovation is anticipated to drive market growth, with projections indicating a market size of 6.91 USD Billion by 2035.