RESEARCH METHODOLOGY on Data Center Service Market

Introduction

The inherent complexity of the global Data Center Services (DCS) industry and the diversity of its uses has necessitated a research methodology that not only captures the scope of the industry, but also details its major factors and trends, new technologies and innovations, customers and their needs and preferences, the most important types of services, the potential penetration of the services, and the potential markets in which they may be deployed. Market Research Future (MRFR) has adopted an empirical approach to this research process, combining primary and secondary market data sources, along with expert interviews, to accurately analyze the DCS segment.

Primary Data Collection

For this research, MRFR conducted both online and offline surveys and interviews with prominent stakeholders, including companies operating in the space, sectoral stakeholders and industry experts. Relevant questionnaires, which focus on various themes, were mailed to the identified participants. The collected information has been approved for statistical purposes. The feedback and insights of the stakeholders were combined with industry data and report to gain in-depth insights into the DCS segment and its competitive landscape.

Secondary Data Collection

To supplement MRFR's research methodology, secondary sources comprising market reports, white papers, journals, databases, and press releases from various organizations and publications pertaining to the DCS space have also been referred to and analyzed. These are trusted sources and are considered crucial to the accuracy of the research.

Research Data Analysis

Once all of the research data is collected and analyzed, a comprehensive report has been created that emphasizes important developments and trends in the DCS segment. The report presents the current and future market dynamics, market share analyses, and a distinct overview of the competitive landscape.

Conclusion

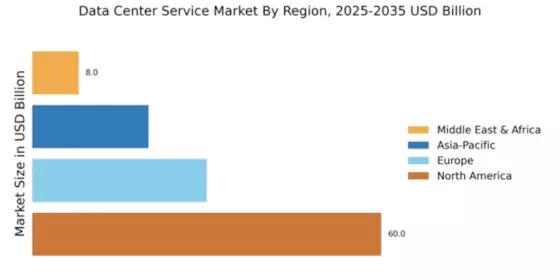

Through its dedicated research methodology, MRFR has studied, compiled and presented a detailed and accurate overview of the DCS segment and its competitive landscape. According to the report, the global DCS market is projected to reach all-time high revenue by 2025 and the services will continue to be in high demand due to their crucial role in the growth of data centres, industrial IoT, and other internet-connected applications. The report further offers a comprehensive analysis of the major drivers and restraining factors, potential market drivers and challenges, major market segments, and key regional segmentation to help market players in making sound decisions in their strategic and operational planning.