Emergence of Edge Computing

The Data Center Server Market is witnessing a transformative shift with the emergence of edge computing. This paradigm decentralizes data processing, bringing computation closer to the data source, which is particularly beneficial for applications requiring low latency. As industries such as IoT and autonomous vehicles gain traction, the demand for edge computing solutions is expected to surge. By 2025, the edge computing market is projected to reach a valuation of several billion dollars, indicating a substantial opportunity for data centers to innovate their server offerings. This trend compels data centers to integrate edge capabilities into their existing infrastructure, thereby enhancing their service portfolio and meeting the evolving needs of clients.

Increased Demand for Data Processing

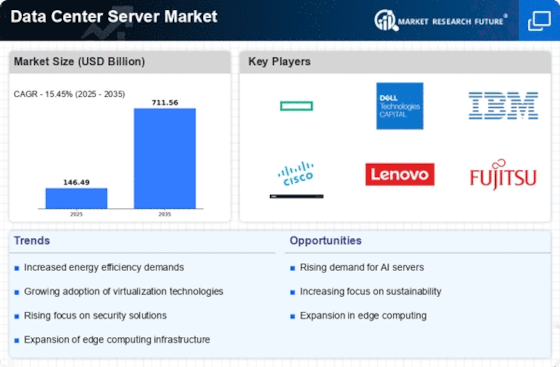

The Data Center Server Market experiences heightened demand for data processing capabilities, driven by the proliferation of data generation across various sectors. As organizations increasingly rely on data analytics for decision-making, the need for robust server infrastructure becomes paramount. In 2025, the market is projected to witness a compound annual growth rate of approximately 10%, reflecting the urgency for enhanced processing power. This trend is further fueled by the rise of big data technologies, which necessitate advanced server solutions to manage and analyze vast datasets efficiently. Consequently, data centers are compelled to upgrade their server capabilities to accommodate this growing demand, ensuring they remain competitive in an evolving digital landscape.

Regulatory Compliance and Data Security

The Data Center Server Market is increasingly shaped by regulatory compliance and data security concerns. Organizations are mandated to adhere to stringent regulations regarding data protection, which necessitates the implementation of secure server solutions. In 2025, the market for data security solutions is expected to grow significantly, driven by the need for compliance with regulations such as GDPR and CCPA. Data centers must invest in advanced security measures, including encryption and access controls, to safeguard sensitive information. This focus on security not only protects organizations from potential breaches but also enhances the overall credibility of data center services, making them more attractive to clients.

Expansion of E-commerce and Digital Services

The Data Center Server Market is significantly influenced by the expansion of e-commerce and digital services. As consumer behavior shifts towards online shopping and digital interactions, businesses are investing heavily in their online infrastructure. This shift is expected to drive server demand, as companies require reliable and scalable solutions to support their operations. In 2025, the e-commerce sector is anticipated to grow by over 15%, necessitating enhanced server capabilities to handle increased traffic and transactions. Data centers must adapt to this trend by optimizing their server configurations, ensuring they can support the high availability and performance required by modern digital services.

Technological Advancements in Server Architecture

The Data Center Server Market is propelled by continuous technological advancements in server architecture. Innovations such as virtualization, containerization, and high-density servers are revolutionizing how data centers operate. These advancements enable more efficient resource utilization, reducing operational costs while enhancing performance. In 2025, the adoption of next-generation server technologies is expected to increase, as organizations seek to optimize their data center operations. This trend encourages data centers to invest in cutting-edge server solutions that can support diverse workloads and improve energy efficiency. As a result, the market is likely to see a shift towards more agile and scalable server architectures, aligning with the demands of modern enterprises.