Adoption of Edge Computing

The shift towards edge computing is reshaping the Data Center Networking Market. As businesses increasingly deploy edge devices to process data closer to the source, the demand for networking solutions that facilitate this transition grows. Edge computing reduces latency and enhances real-time data processing, which is crucial for applications such as IoT and autonomous systems. By 2025, it is estimated that over 75 billion devices will be connected to the internet, further amplifying the need for efficient networking solutions. This trend compels data centers to adapt their networking strategies to support distributed architectures, thereby driving innovation and investment in the Data Center Networking Market. The integration of edge computing solutions is likely to create new opportunities for networking providers, as they develop technologies that cater to the unique requirements of edge environments.

Emergence of 5G Technology

The rollout of 5G technology is set to revolutionize the Data Center Networking Market. With its promise of ultra-fast data transfer speeds and low latency, 5G enables new applications and services that require robust networking capabilities. As industries such as healthcare, manufacturing, and entertainment embrace 5G, the demand for data center networking solutions that can support these advancements escalates. By 2025, it is anticipated that 5G networks will cover a significant portion of the population, leading to increased data traffic and necessitating enhanced networking infrastructure. This technological evolution compels data centers to upgrade their networking capabilities to accommodate the influx of data generated by 5G applications. Consequently, the Data Center Networking Market is likely to experience substantial growth as organizations invest in networking solutions that can leverage the benefits of 5G.

Growing Cybersecurity Concerns

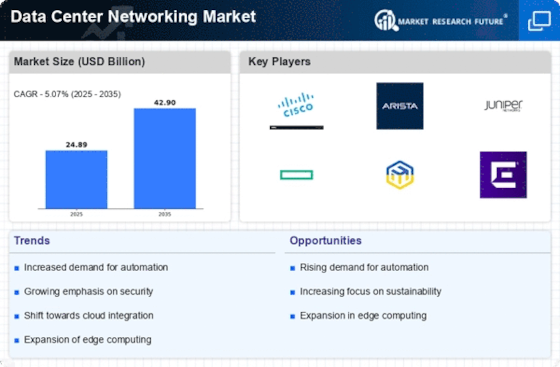

As cyber threats become more sophisticated, the emphasis on cybersecurity within the Data Center Networking Market intensifies. Organizations are increasingly aware of the potential risks associated with data breaches and cyberattacks, prompting them to invest in advanced networking solutions that prioritize security. The Data Center Networking is projected to reach 345 billion dollars by 2026, reflecting the urgency of addressing these challenges. Data centers must implement robust security protocols and technologies to protect sensitive information and maintain operational integrity. This trend drives demand for networking solutions that integrate security features, such as firewalls and intrusion detection systems. The Data Center Networking Market is thus evolving to meet the growing need for secure networking environments, ensuring that organizations can safeguard their data against emerging threats.

Rising Demand for Data Processing

The increasing volume of data generated by businesses and consumers drives the need for efficient data processing capabilities. As organizations seek to harness big data analytics, the Data Center Networking Market experiences heightened demand for advanced networking solutions. In 2025, the data generated globally is projected to reach 175 zettabytes, necessitating robust networking infrastructure to manage this influx. This surge in data requires data centers to enhance their networking capabilities, ensuring seamless data flow and processing. Consequently, companies are investing in high-speed networking technologies, which are essential for maintaining competitive advantage in a data-driven landscape. The Data Center Networking Market is thus poised for growth as organizations prioritize investments in networking solutions that can support their data processing needs.

Increased Focus on Energy Efficiency

Energy efficiency has become a paramount concern for data centers, significantly influencing the Data Center Networking Market. As energy costs rise and environmental regulations tighten, organizations are compelled to adopt energy-efficient networking solutions. The global data center energy consumption is projected to reach 1,000 terawatt-hours by 2025, prompting a shift towards sustainable practices. Networking technologies that minimize energy usage while maximizing performance are in high demand. This trend encourages innovation in the design of networking equipment, such as energy-efficient switches and routers. Furthermore, companies are increasingly seeking solutions that not only reduce operational costs but also align with corporate sustainability goals. The Data Center Networking Market is thus witnessing a transformation as energy efficiency becomes a critical factor in purchasing decisions.