Rising Demand for Data Centers

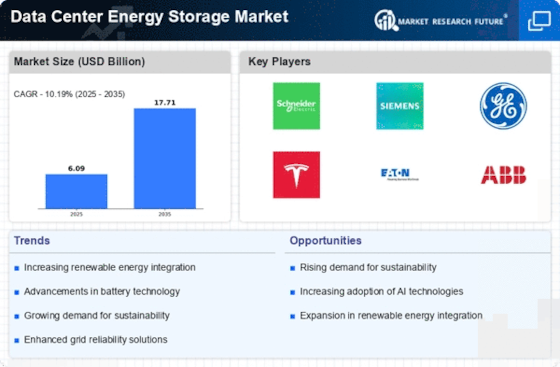

The increasing reliance on digital services and cloud computing has led to a surge in data center construction. This trend appears to drive the Data Center Energy Storage Market, as operators seek to enhance their energy resilience and efficiency. According to recent estimates, the number of data centers is projected to grow by approximately 20% over the next five years. This expansion necessitates robust energy storage solutions to manage peak loads and ensure uninterrupted service. As data centers consume a significant portion of global electricity, energy storage systems are becoming essential for balancing supply and demand. The Data Center Energy Storage Market is thus likely to benefit from this rising demand, as companies invest in advanced storage technologies to optimize their operations.

Increased Focus on Sustainability

The growing emphasis on sustainability and corporate social responsibility is influencing the Data Center Energy Storage Market. Companies are increasingly seeking to reduce their carbon footprints and enhance their environmental performance. This trend is prompting data center operators to invest in energy storage systems that facilitate the use of renewable energy sources, such as solar and wind. By integrating energy storage solutions, data centers can store excess energy generated during peak production times and utilize it during periods of high demand. This approach not only supports sustainability goals but also enhances operational efficiency. The Data Center Energy Storage Market is likely to benefit from this shift towards sustainable practices, as more organizations prioritize environmentally friendly energy solutions.

Technological Innovations in Energy Storage

Advancements in energy storage technologies, particularly in battery systems, are transforming the Data Center Energy Storage Market. Innovations such as lithium-ion batteries, flow batteries, and solid-state batteries are enhancing energy density, lifespan, and safety. These technological improvements are likely to reduce costs and increase the efficiency of energy storage systems, making them more attractive to data center operators. As the market for energy storage solutions evolves, the Data Center Energy Storage Market is expected to witness a shift towards more sophisticated and efficient storage technologies. The integration of artificial intelligence and machine learning in energy management systems may further optimize energy usage, thereby driving the adoption of energy storage solutions in data centers.

Cost-Effectiveness of Energy Storage Systems

The declining costs of energy storage technologies are making them increasingly viable for data center operators, thereby impacting the Data Center Energy Storage Market. As battery prices continue to fall, the return on investment for energy storage systems improves, making them an attractive option for managing energy costs. This trend is particularly relevant as data centers face rising electricity prices and demand charges. By implementing energy storage solutions, operators can mitigate these costs and enhance their overall energy management strategies. The Data Center Energy Storage Market is expected to see a surge in adoption as more companies recognize the financial benefits associated with energy storage systems. This cost-effectiveness is likely to drive further innovation and competition within the market.

Regulatory Support for Energy Storage Solutions

Government policies and regulations increasingly favor the adoption of energy storage technologies, which is likely to bolster the Data Center Energy Storage Market. Various jurisdictions are implementing incentives and subsidies to promote energy efficiency and renewable energy integration. For instance, regulations mandating a certain percentage of energy to be sourced from renewables are compelling data center operators to invest in energy storage systems. This regulatory landscape appears to create a favorable environment for the growth of the Data Center Energy Storage Market, as compliance with these regulations often necessitates the deployment of advanced storage solutions. The potential for financial incentives may further encourage data center operators to adopt energy storage technologies, thereby enhancing market growth.