Technological Innovations

dairy Products Processing Equipment

Expansion of Emerging Markets

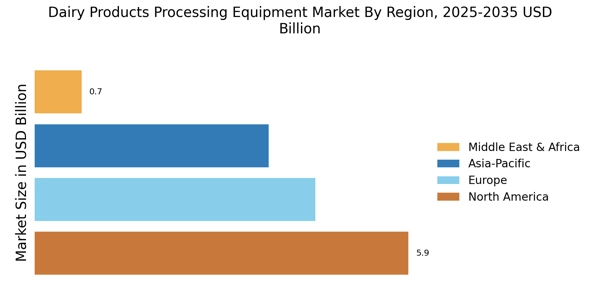

The expansion of emerging markets is a significant driver for the dairy products processing equipment Market, as these regions exhibit increasing consumption of dairy products. Economic growth, rising disposable incomes, and changing dietary patterns in countries such as India, Brazil, and China are contributing to a burgeoning demand for dairy. This trend necessitates the establishment of efficient processing facilities equipped with modern technology to cater to the growing market. As a result, manufacturers are focusing on developing tailored solutions that meet the specific needs of these emerging markets. The potential for growth in these regions presents lucrative opportunities for companies within the Dairy Products Processing Equipment Market. The interplay between market expansion and equipment innovation is likely to drive sustained growth in the coming years.

Focus on Food Safety and Quality

The emphasis on food safety and quality assurance is increasingly influencing the Dairy Products Processing Equipment Market. Regulatory bodies and consumer awareness regarding food safety standards have heightened the need for equipment that ensures compliance with stringent regulations. Manufacturers are now prioritizing the implementation of advanced processing technologies that minimize contamination risks and enhance product integrity. The market is witnessing a shift towards equipment that incorporates features such as automated cleaning systems and real-time quality monitoring. This focus on safety not only protects consumers but also bolsters brand reputation and trust. As a result, investments in high-quality processing equipment are likely to increase, further propelling the Dairy Products Processing Equipment Market. The alignment of safety standards with processing capabilities is essential for sustaining growth in this sector.

Rising Demand for Dairy Products

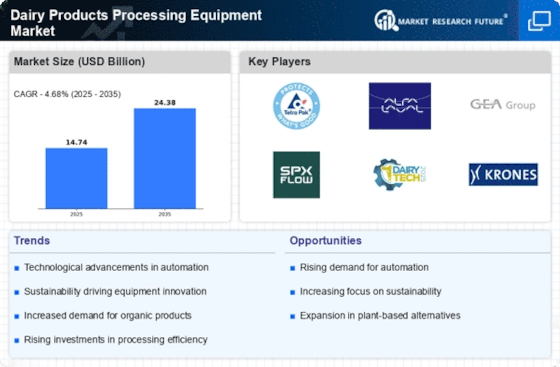

The Dairy Products Processing Equipment Market is experiencing a notable surge in demand for dairy products, driven by changing consumer preferences and dietary habits. As populations grow and urbanization increases, the consumption of dairy products such as cheese, yogurt, and milk is on the rise. According to recent data, the dairy sector is projected to expand at a compound annual growth rate of approximately 4.5% over the next few years. This growth necessitates advanced processing equipment to meet the increasing production requirements, thereby propelling the Dairy Products Processing Equipment Market forward. Manufacturers are compelled to invest in innovative technologies to enhance efficiency and product quality, which further stimulates market growth. The interplay between consumer demand and production capabilities is likely to shape the future landscape of the dairy processing sector.

Sustainability and Environmental Concerns

Sustainability initiatives are becoming increasingly relevant within the Dairy Products Processing Equipment Market, as both consumers and manufacturers prioritize environmentally friendly practices. The dairy sector is under pressure to reduce its carbon footprint and implement sustainable production methods. This has led to a growing demand for energy-efficient processing equipment that minimizes resource consumption and waste generation. Companies are exploring innovative solutions such as renewable energy sources and waste recycling systems to enhance sustainability. The market for eco-friendly processing equipment is projected to expand as businesses seek to align with consumer expectations and regulatory requirements. This trend not only addresses environmental concerns but also presents opportunities for differentiation in a competitive landscape. The commitment to sustainability is likely to shape the future direction of the Dairy Products Processing Equipment Market.