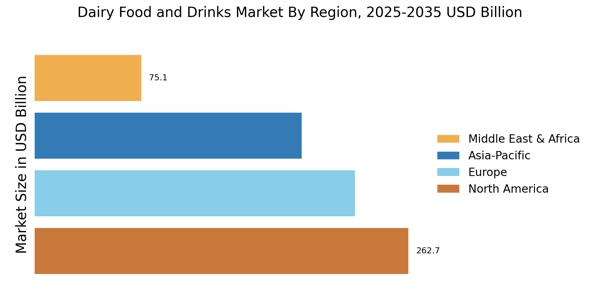

North America : Market Leader in Dairy

North America is the largest market for dairy food and drinks, holding approximately 35% of the global market share. Key growth drivers include increasing health consciousness, demand for organic products, and innovations in dairy alternatives. Regulatory support, such as the USDA's initiatives for dairy farming sustainability, further catalyzes growth. The U.S. and Canada are the primary contributors, with the U.S. alone accounting for about 30% of the market share.

The competitive landscape is characterized by major players like Dairy Farmers of America, Nestle, and Danone, which dominate the market with a diverse range of products. The presence of these key players fosters innovation and competition, leading to a variety of offerings that cater to changing consumer preferences. The market is also witnessing a rise in plant-based dairy alternatives, reflecting shifting consumer trends towards healthier options.

Europe : Diverse and Innovative Market

Europe is a significant player in the dairy food and drinks market, holding around 30% of the global market share. The region benefits from a rich dairy heritage, with increasing demand for premium and organic dairy products driving growth. Regulatory frameworks, such as the EU's Common Agricultural Policy, support sustainable dairy farming practices, enhancing market stability. Germany and France are the largest markets, contributing approximately 25% and 20% of the European market share, respectively.

Leading countries in Europe include Germany, France, and the Netherlands, with key players like Lactalis, FrieslandCampina, and Arla Foods dominating the landscape. The competitive environment is marked by innovation in product offerings, including lactose-free and fortified dairy products. The presence of established brands and a focus on quality and sustainability are pivotal in maintaining market leadership, catering to the evolving preferences of health-conscious consumers.

Asia-Pacific : Emerging Market Potential

The Asia-Pacific region is rapidly emerging in the dairy food and drinks market, holding approximately 25% of the global market share. Key growth drivers include rising disposable incomes, urbanization, and increasing health awareness among consumers. Countries like China and India are leading this growth, with China alone accounting for about 15% of the market share. Regulatory support for dairy production and food safety standards is also enhancing market dynamics.

China, India, and New Zealand are the leading countries in this region, with significant contributions from local and international players. Companies like Fonterra and Danone are expanding their presence, focusing on product innovation and catering to local tastes. The competitive landscape is evolving, with a growing demand for value-added dairy products, including yogurt and cheese, reflecting changing consumer preferences towards healthier options.

Middle East and Africa : Untapped Market Opportunities

The Middle East and Africa region is witnessing significant growth in the dairy food and drinks market, holding around 10% of the global market share. Key drivers include population growth, urbanization, and increasing demand for dairy products among consumers. Countries like South Africa and Egypt are leading the market, with South Africa contributing approximately 5% of the total market share. Regulatory frameworks are gradually improving, supporting local dairy production and food safety standards.

South Africa, Egypt, and Kenya are the primary markets in this region, with local players and international companies like Danone and Lactalis expanding their footprint. The competitive landscape is characterized by a mix of traditional dairy products and innovative offerings, such as flavored milk and cheese. The region's untapped potential presents opportunities for growth, particularly in value-added dairy products that cater to evolving consumer preferences.