Rising Demand for Personalization

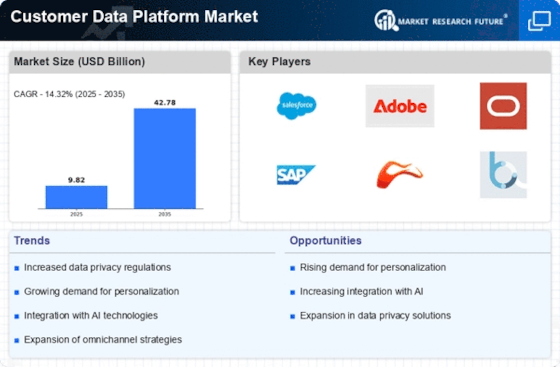

The Customer Data Platform Market is experiencing a notable surge in demand for personalized customer experiences. Businesses are increasingly recognizing that tailored marketing strategies can significantly enhance customer engagement and loyalty. According to recent data, companies utilizing customer data platforms report a 20% increase in customer retention rates. This trend is driven by the need to analyze vast amounts of customer data to create individualized marketing campaigns. As organizations strive to differentiate themselves in a competitive landscape, the ability to leverage customer insights effectively becomes paramount. Consequently, the Customer Data Platform Market is likely to witness continued growth as businesses invest in technologies that facilitate personalized interactions.

Regulatory Compliance and Data Governance

The Customer Data Platform Market is significantly influenced by the growing emphasis on regulatory compliance and data governance. As data privacy regulations become more stringent, organizations are compelled to adopt customer data platforms that ensure compliance with legal requirements. Recent surveys indicate that 70% of businesses consider data privacy a top priority, leading to increased investments in data governance solutions. This trend is likely to drive the adoption of customer data platforms, as they provide the necessary tools for managing customer data responsibly. Consequently, the Customer Data Platform Market is expected to expand as organizations seek to navigate the complexities of data regulations.

Growth of E-commerce and Digital Marketing

The Customer Data Platform Market is poised for expansion due to the rapid growth of e-commerce and digital marketing channels. With online shopping becoming increasingly prevalent, businesses are compelled to adopt customer data platforms to optimize their marketing efforts. Recent statistics indicate that e-commerce sales have surged, with projections suggesting a 25% increase in online retail sales over the next few years. This shift necessitates the integration of customer data platforms to analyze consumer behavior and preferences effectively. As companies seek to enhance their online presence and drive sales, the Customer Data Platform Market is likely to benefit from this digital transformation.

Increased Focus on Data-Driven Decision Making

The Customer Data Platform Market is witnessing a paradigm shift towards data-driven decision making. Organizations are increasingly relying on data analytics to inform their strategies and operations. This trend is underscored by the fact that companies utilizing data-driven approaches are 5 times more likely to make faster decisions than their competitors. As businesses recognize the value of actionable insights derived from customer data, the demand for customer data platforms is expected to rise. This shift not only enhances operational efficiency but also fosters a culture of continuous improvement within organizations. The Customer Data Platform Market is thus likely to thrive as more companies embrace data-centric methodologies.

Advancements in Technology and Integration Capabilities

The Customer Data Platform Market is benefiting from rapid advancements in technology and integration capabilities. The emergence of cloud computing and API-driven architectures has enabled seamless integration of customer data platforms with existing systems. This technological evolution allows businesses to consolidate data from various sources, enhancing the accuracy and comprehensiveness of customer insights. Recent reports suggest that organizations leveraging integrated customer data platforms experience a 30% improvement in marketing campaign effectiveness. As technology continues to evolve, the Customer Data Platform Market is likely to see increased adoption as businesses seek to harness the power of integrated data solutions.