Growing Retail Sector

The expansion of the retail sector significantly impacts the Global Currency Counting Machine Market Industry. As retail businesses grow, the volume of cash transactions increases, necessitating efficient cash management solutions. Currency counting machines become indispensable tools for retailers to manage cash flow effectively. The market's growth is reflected in the projected increase from 1.66 USD Billion in 2024 to 2.45 USD Billion by 2035. Retailers are increasingly recognizing the value of investing in these machines to enhance operational efficiency and reduce the risk of cash handling errors. This trend is expected to continue, driving further demand in the market.

Regulatory Compliance

Regulatory compliance is increasingly influencing the Currency Counting Machine Industry. Financial institutions and businesses are required to adhere to stringent regulations regarding cash handling and anti-money laundering practices. Currency counting machines equipped with advanced features that ensure compliance are in high demand. This necessity compels organizations to invest in reliable machines that can accurately count and sort currency while providing necessary reporting capabilities. As regulatory frameworks evolve, the market is likely to see a surge in demand for machines that meet these compliance standards, further propelling market growth.

Rising Cash Transactions

Despite the increasing prevalence of digital payments, cash transactions remain significant in many economies. The Global Currency Counting Machine Industry benefits from this ongoing reliance on cash, particularly in developing regions where cash is still the primary mode of transaction. In 2024, the market is expected to be valued at 1.66 USD Billion, driven by the need for efficient cash management solutions. Retailers, banks, and other businesses require reliable currency counting machines to handle cash efficiently. As cash transactions continue to be prevalent, the demand for these machines is anticipated to grow, supporting the overall market expansion.

Technological Advancements

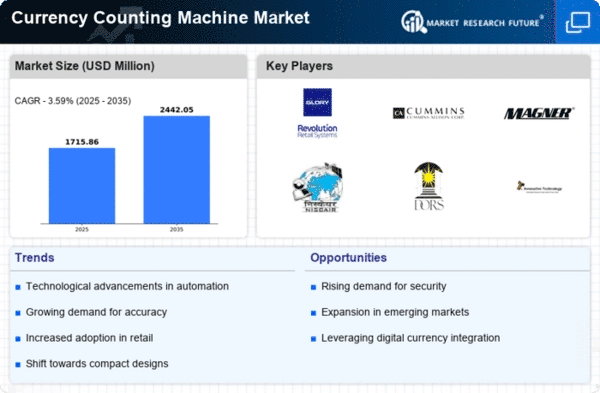

Technological advancements play a crucial role in shaping the Currency Counting Machine Industry. Innovations such as counterfeit detection, advanced sorting capabilities, and integration with digital payment systems enhance the functionality of currency counting machines. These features not only improve accuracy but also streamline cash handling processes. As the market evolves, manufacturers are likely to invest in research and development to introduce cutting-edge technologies. The anticipated growth from 1.66 USD Billion in 2024 to 2.45 USD Billion by 2035, with a CAGR of 3.59% from 2025 to 2035, underscores the importance of technology in driving market expansion.

Market Trends and Projections

The Currency Counting Machine Market is poised for growth, with projections indicating a rise from 1.66 USD Billion in 2024 to 2.45 USD Billion by 2035. The market is expected to experience a compound annual growth rate (CAGR) of 3.59% from 2025 to 2035. This growth trajectory suggests a robust demand for currency counting machines across various sectors, including banking, retail, and hospitality. Factors such as increased cash transactions, technological advancements, and regulatory compliance are likely to contribute to this upward trend. The market's dynamics indicate a promising future for manufacturers and stakeholders in the currency counting machine sector.

Increased Demand for Automation

The Currency Counting Machine Market experiences heightened demand for automation in financial institutions and retail sectors. As businesses strive for efficiency, the adoption of currency counting machines becomes essential. These machines reduce human error and expedite cash handling processes. In 2024, the market is projected to reach 1.66 USD Billion, reflecting a growing reliance on automated solutions. This trend is particularly evident in regions with high cash transaction volumes, where the need for accuracy and speed is paramount. The shift towards automation is likely to drive further innovations in machine technology, enhancing user experience and operational efficiency.