Expansion of Cryptocurrency Trading Platforms

The emergence of cryptocurrency trading platforms is reshaping the Currency Exchange Software Market. As digital currencies gain traction, there is a growing need for software that facilitates the exchange of both traditional currencies and cryptocurrencies. This trend is driven by increasing consumer interest in digital assets and the desire for diversified investment options. Market Research Future reveal that the cryptocurrency exchange segment is expected to grow significantly, with projections indicating a potential doubling of market size within the next few years. This expansion presents opportunities for software developers to create integrated solutions that cater to the needs of both traditional and digital currency traders.

Rise of Mobile Currency Exchange Applications

The proliferation of mobile technology is significantly influencing the Currency Exchange Software Market. With the increasing use of smartphones, there is a growing trend towards mobile currency exchange applications that allow users to conduct transactions on-the-go. This shift is particularly appealing to younger consumers who prefer the convenience of mobile solutions. Market data suggests that mobile currency exchange applications are expected to capture a substantial share of the market, with projections indicating a growth rate of around 10% annually. This trend underscores the importance of mobile accessibility in currency exchange software, prompting developers to create user-friendly applications that cater to this demand.

Regulatory Compliance and Security Enhancements

In the Currency Exchange Software Market, regulatory compliance has become a critical driver. Financial institutions and currency exchange platforms are increasingly required to adhere to stringent regulations aimed at preventing fraud and ensuring secure transactions. This has led to a heightened focus on security features within currency exchange software. As a result, software providers are investing in advanced security measures, such as encryption and multi-factor authentication, to protect user data and maintain compliance. The market for compliance-focused currency exchange solutions is expected to expand, as businesses prioritize security to build trust with their customers and mitigate risks associated with currency transactions.

Growing Demand for Real-Time Currency Exchange Solutions

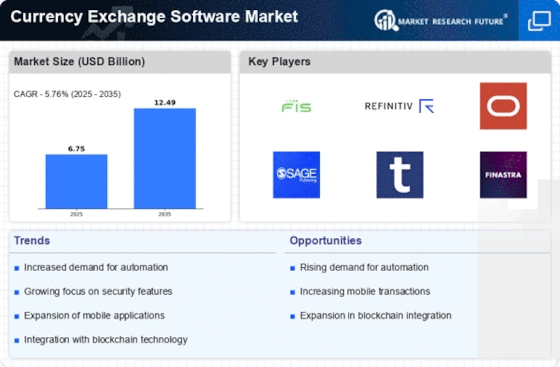

The Currency Exchange Software Market is experiencing a notable surge in demand for real-time currency exchange solutions. Businesses and individuals increasingly require immediate access to currency rates and transaction capabilities. This trend is driven by the rise of e-commerce and international trade, where timely currency conversion can significantly impact profitability. According to recent data, the market for real-time currency exchange solutions is projected to grow at a compound annual growth rate of approximately 8% over the next five years. This growth indicates a shift towards more efficient and responsive currency exchange processes, compelling software providers to innovate and enhance their offerings to meet these evolving needs.

Integration of Artificial Intelligence and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) technologies is transforming the Currency Exchange Software Market. These technologies enable software to analyze vast amounts of data, predict currency trends, and optimize exchange rates in real-time. As businesses seek to enhance their decision-making processes, the demand for AI-driven currency exchange solutions is likely to increase. Market analysts indicate that the adoption of AI and ML in currency exchange software could lead to improved accuracy in forecasting and more efficient transaction processing. This technological advancement not only enhances user experience but also positions companies to remain competitive in a rapidly evolving market.