Supportive Regulatory Frameworks

Supportive regulatory frameworks play a crucial role in shaping the Crystalline Solar PV Backsheet Market. Governments worldwide are implementing policies that encourage the adoption of solar energy, including tax incentives, subsidies, and renewable energy mandates. These regulations create a favorable environment for solar energy investments, leading to increased installations of solar panels. In 2025, it is anticipated that regulatory support will continue to bolster the market, as countries aim to achieve their renewable energy targets. This supportive landscape not only drives demand for solar panels but also necessitates high-quality backsheets that meet stringent safety and performance standards, thereby benefiting manufacturers in the crystalline solar PV backsheet sector.

Rising Demand for Renewable Energy

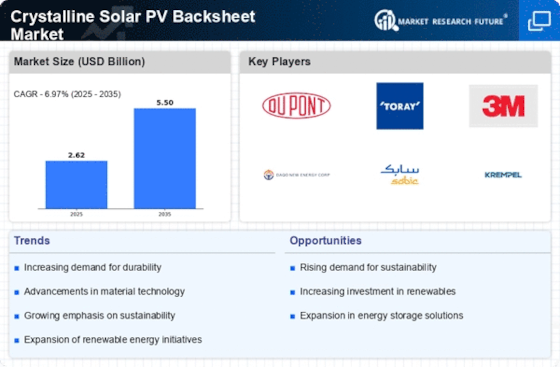

The increasing The Crystalline Solar PV Backsheet Industry. As nations strive to meet their energy needs sustainably, the demand for solar energy solutions has surged. In 2025, the solar energy sector is projected to grow at a compound annual growth rate of approximately 20%, indicating a robust market for solar components, including backsheets. This heightened demand is largely fueled by government initiatives aimed at reducing carbon emissions and promoting clean energy technologies. Consequently, manufacturers of crystalline solar PV backsheets are likely to experience increased orders, as solar panel installations rise in response to this global shift towards sustainability.

Growing Awareness of Environmental Issues

The growing awareness of environmental issues among consumers and businesses is a significant driver for the Crystalline Solar PV Backsheet Market. As climate change concerns escalate, there is a marked shift towards sustainable practices, including the adoption of solar energy solutions. This heightened awareness is prompting both residential and commercial sectors to invest in solar technologies, thereby increasing the demand for solar panels and their components, such as backsheets. In 2025, it is expected that this trend will continue, with more stakeholders recognizing the long-term benefits of solar energy. Consequently, manufacturers of crystalline solar PV backsheets may find themselves in a favorable position to capitalize on this growing market, as eco-conscious consumers seek reliable and efficient solar solutions.

Increased Investment in Solar Infrastructure

Increased investment in solar infrastructure is a pivotal driver for the Crystalline Solar PV Backsheet Market. As countries and corporations allocate substantial resources towards expanding solar energy capacity, the demand for high-quality solar components, including backsheets, is likely to rise. In 2025, investments in solar infrastructure are projected to reach unprecedented levels, driven by both public and private sector funding. This influx of capital not only supports the installation of new solar projects but also encourages innovation in materials and manufacturing processes. As a result, manufacturers of crystalline solar PV backsheets may benefit from enhanced production capabilities and increased market share, positioning themselves favorably in a rapidly evolving industry.

Technological Innovations in Solar Technology

Technological advancements in solar technology are significantly influencing the Crystalline Solar PV Backsheet Market. Innovations such as improved photovoltaic cell efficiency and enhanced durability of backsheets are driving market growth. For instance, the introduction of new materials and manufacturing processes has led to backsheets that offer better thermal stability and UV resistance. These advancements not only extend the lifespan of solar panels but also improve their overall performance. As a result, the market for crystalline solar PV backsheets is expected to expand, with manufacturers investing in research and development to stay competitive. The integration of smart technologies into solar systems further enhances the appeal of these products, potentially increasing their adoption in various applications.