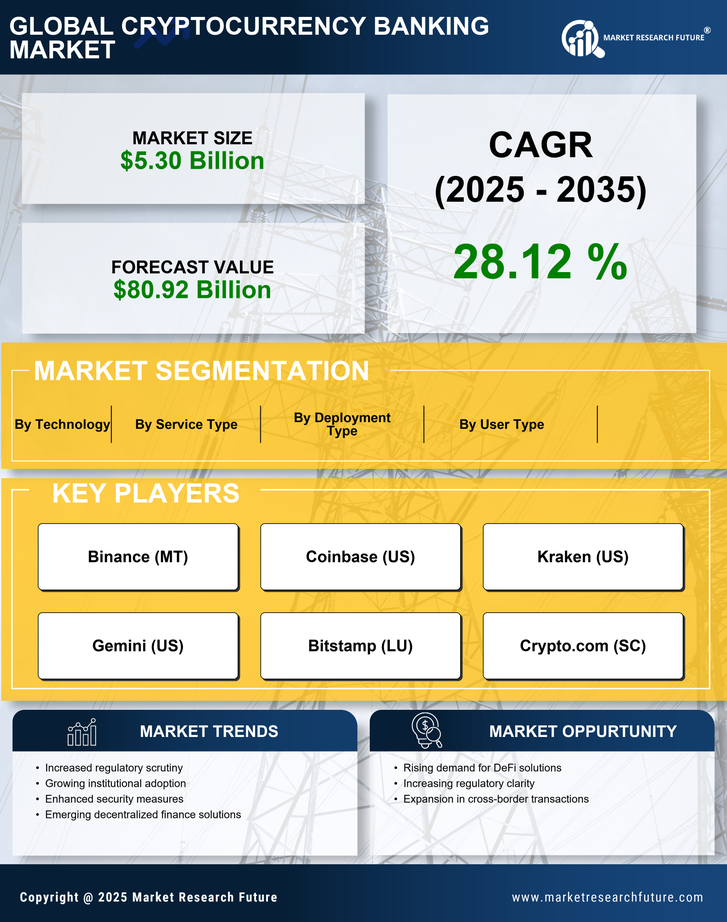

Emergence of Regulatory Clarity

The emergence of regulatory clarity surrounding cryptocurrencies is a crucial driver for the Cryptocurrency Banking Market. As governments and regulatory bodies establish frameworks for digital assets, financial institutions are more inclined to engage with cryptocurrencies. Recent initiatives in various jurisdictions have led to clearer guidelines, which may foster a safer environment for both consumers and businesses. This regulatory clarity could potentially increase institutional investment in cryptocurrencies, further legitimizing their use in banking. Consequently, the Cryptocurrency Banking Market is likely to experience growth as banks adapt to these regulations and develop compliant services that cater to the needs of their clients.

Increased Adoption of Digital Assets

The rising acceptance of digital assets among consumers and businesses appears to be a pivotal driver for the Cryptocurrency Banking Market. As more individuals and institutions recognize the potential of cryptocurrencies, the demand for banking services that accommodate these assets is likely to surge. Recent data indicates that approximately 25% of adults in various regions have engaged with cryptocurrencies, suggesting a growing market. This trend compels traditional banks to innovate and integrate cryptocurrency services, thereby enhancing their offerings. Consequently, the Cryptocurrency Banking Market is expected to expand as financial institutions strive to meet the evolving needs of their clients, potentially leading to a more inclusive financial ecosystem.

Rise of Innovative Financial Products

The rise of innovative financial products within the Cryptocurrency Banking Market is reshaping the landscape of financial services. Products such as crypto loans, interest-bearing accounts, and yield farming are gaining traction among consumers seeking alternative investment opportunities. Data indicates that the total value locked in DeFi protocols has surpassed USD 100 billion, reflecting a growing interest in these innovative offerings. As traditional banks begin to explore and adopt similar products, the Cryptocurrency Banking Market is poised for expansion. This trend suggests that financial institutions are increasingly recognizing the potential of cryptocurrencies to diversify their product portfolios and attract a broader customer base.

Growing Demand for Financial Inclusion

The growing demand for financial inclusion is significantly influencing the Cryptocurrency Banking Market. Many individuals in underserved regions lack access to traditional banking services, creating an opportunity for cryptocurrency-based solutions. Cryptocurrencies can provide a means for these populations to engage in financial activities, such as saving and transferring money, without the barriers posed by conventional banking systems. Recent studies suggest that nearly 1.7 billion adults remain unbanked, highlighting the potential market for cryptocurrency banking services. As financial institutions recognize this demand, they are likely to develop tailored products that cater to these underserved communities, thereby expanding the Cryptocurrency Banking Market.

Technological Advancements in Blockchain

Technological advancements in blockchain technology are transforming the Cryptocurrency Banking Market. Innovations such as smart contracts and enhanced security protocols are making cryptocurrency transactions more efficient and secure. The market for blockchain technology is projected to reach USD 163 billion by 2027, indicating a robust growth trajectory. These advancements not only facilitate faster transactions but also reduce costs associated with traditional banking methods. As a result, banks are increasingly adopting blockchain solutions to streamline their operations and offer better services to customers. This shift is likely to bolster the Cryptocurrency Banking Market, as more institutions recognize the benefits of integrating blockchain technology into their financial services.