Top Industry Leaders in the Crude to chemicals Market

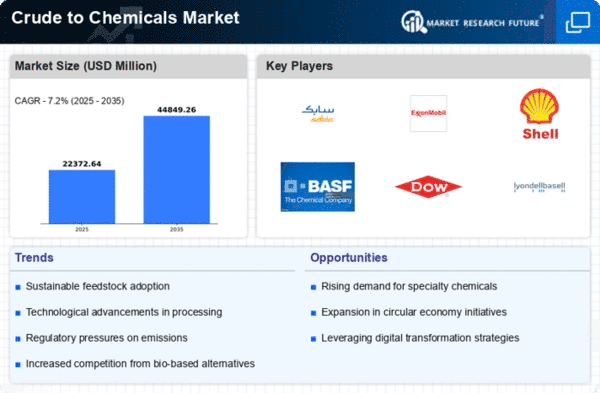

Crude to chemicals Market

The crude-to-chemicals (CTC) market is at a crossroads, facing both opportunities and challenges as it navigates a shifting energy landscape. Traditionally focused on transportation fuels, the industry is increasingly turning towards higher-margin chemicals production to counter declining fuel demand and stricter environmental regulations. This transition has sparked intense competition, prompting players to adopt diverse strategies to gain market share.

Strategies Shaping the CTC Landscape:

-

Integration: Mergers and acquisitions are on the rise, as established refiners seek to integrate with petrochemical companies, creating vertically integrated giants like ExxonMobil and Saudi Aramco. This synergy strengthens feedstock access, optimizes production processes, and facilitates entry into new markets. -

Technological Advancements: Development of advanced CTC technologies like olefin conversion and methanol-to-olefins (MTO) is crucial. These innovations enable conversion of a wider range of crude oils into valuable chemicals, improving profitability and flexibility. -

Geographical Expansion: Asia, particularly China and India, is witnessing a surge in CTC investments due to rising demand for chemicals and access to cheap feedstock. Established players are venturing into these regions, while local companies are ramping up their capabilities. -

Sustainability Focus: Growing pressure to reduce carbon footprint is driving investments in renewable feedstocks and carbon capture and storage (CCS) technologies. Companies like BP and Shell are exploring bio-based CTC pathways to cater to the evolving market demands.

Factors Influencing Market Share:

-

Feedstock Advantage: Access to reliable and cost-effective crude oil feedstock is paramount. Companies with established upstream operations or strategic partnerships with oil producers hold an edge. -

Technological Prowess: Possession of advanced CTC technologies and expertise in process optimization translates to higher efficiency and product yields, boosting competitiveness. -

Regional Presence: Strong presence in key demand markets like Asia and the Middle East, coupled with robust distribution networks, is crucial for market share gains. -

Financial Strength: Capital-intensive nature of CTC projects demands substantial financial resources. Access to funding and risk management strategies are critical for success.

List of Key Players in the Crude-to-chemicals Market

- Saudi Arabian Oil Co.

- Shell Global

- Indian Oil Corporation Ltd.

- ExxonMobil

- Sinopec

- Hengli Petrochemical

- Reliance Industries among others

Recent Developments:

August 2023: Shell announces a $1 billion investment in a new CTC plant in Singapore, focusing on high-value olefins production.

September 2023: Saudi Aramco and TotalEnergies partner to develop a mega CTC complex in Jubail, Saudi Arabia, with a planned capacity of 1.5 million tons per year of ethylene.

October 2023: BASF launches a new catalyst technology for MTO, aiming to improve efficiency and reduce carbon footprint.

November 2023: China announces plans to invest $30 billion in CTC projects over the next five years to boost domestic chemical production and reduce reliance on imports.

December 2023: ExxonMobil and SABIC collaborate on a joint research project to develop sustainable CTC pathways using bio-based feedstocks.