E-commerce Growth

The Global Covid19 Impact Fmcg Industry 9519Market Overview Industry experiences a notable shift towards e-commerce platforms as consumers increasingly prefer online shopping. In 2024, the industry is projected to reach 350 USD Billion, driven by the convenience and accessibility of digital retail. This trend is particularly pronounced in urban areas where consumers seek quick and safe shopping options. The rise of mobile commerce and the proliferation of digital payment solutions further enhance this growth. As more consumers adapt to online purchasing, the industry is likely to see sustained growth, with e-commerce becoming a dominant channel for FMCG sales.

Supply Chain Resilience

The Global Covid19 Impact Fmcg Industry 9519Market Overview Industry is compelled to enhance supply chain resilience in response to disruptions experienced during previous crises. Companies are investing in technology and logistics to ensure a more robust supply chain capable of withstanding future challenges. This focus on resilience not only mitigates risks but also improves operational efficiency. As firms adopt advanced analytics and automation, they can better predict demand and manage inventory. This strategic shift is essential for maintaining competitiveness in a rapidly evolving market landscape, ultimately supporting the industry's growth trajectory.

Health and Wellness Trends

The Global Covid19 Impact Fmcg Industry 9519Market Overview Industry is significantly influenced by the rising consumer focus on health and wellness. As individuals become more health-conscious, there is an increasing demand for organic, natural, and functional food products. This shift is reflected in the market, with consumers seeking products that offer health benefits, such as immunity boosters and nutritional supplements. The industry's response includes the introduction of innovative products that cater to these preferences, potentially leading to a market size of 600 USD Billion by 2035. This trend indicates a long-term transformation in consumer behavior towards healthier choices.

Sustainability Initiatives

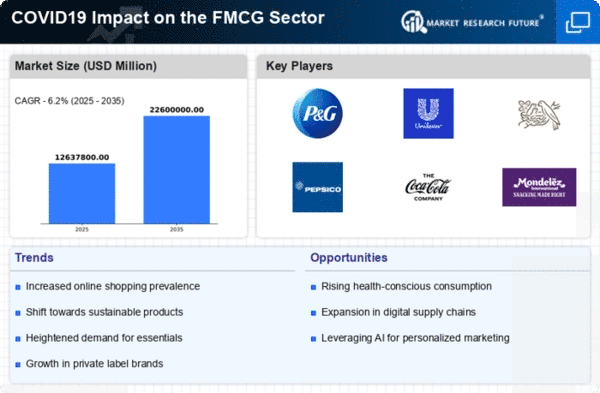

The Global Covid19 Impact Fmcg Industry 9519Market Overview Industry is witnessing a growing emphasis on sustainability and eco-friendly practices. Consumers are increasingly aware of environmental issues and are opting for brands that demonstrate a commitment to sustainable sourcing and packaging. This trend is likely to shape product development and marketing strategies, as companies strive to align with consumer values. The industry's adaptation to sustainability could enhance brand loyalty and attract environmentally conscious consumers, thereby contributing to the projected CAGR of 5.02% from 2025 to 2035. This shift may redefine competitive dynamics within the FMCG sector.

Changing Consumer Preferences

The Global Covid19 Impact Fmcg Industry 9519Market Overview Industry is adapting to rapidly changing consumer preferences, particularly among younger demographics. Millennials and Gen Z consumers prioritize convenience, quality, and brand transparency, influencing their purchasing decisions. This demographic shift is prompting companies to innovate and diversify their product offerings, ensuring alignment with consumer expectations. As brands respond to these preferences, they may experience increased market share and customer loyalty. The industry's ability to adapt to these evolving preferences is crucial for sustaining growth and maintaining relevance in a competitive market.