Rising Demand for Cotton Products

The Cotton Seed Treatment Market is experiencing a surge in demand for cotton products, driven by the increasing consumption of cotton in textiles and apparel. As consumers become more environmentally conscious, the demand for sustainably produced cotton is likely to rise. This trend is reflected in the growing preference for organic cotton, which necessitates effective seed treatment solutions to ensure high-quality yields. In 2023, the cotton production reached approximately 25 million metric tons, indicating a robust market for cotton seed treatment solutions. The need for enhanced seed performance and disease resistance is becoming paramount, thereby propelling the growth of the Cotton Seed Treatment Market.

Government Initiatives and Support

Government policies and initiatives aimed at promoting sustainable agriculture are playing a crucial role in the Cotton Seed Treatment Market. Various countries are implementing regulations that encourage the use of treated seeds to enhance crop productivity and reduce pesticide usage. Financial incentives and subsidies for farmers adopting seed treatment practices are becoming more common. In 2023, several governments allocated significant budgets to support agricultural innovation, which includes funding for research in seed treatment technologies. This support is likely to foster growth in the Cotton Seed Treatment Market, as farmers increasingly recognize the benefits of treated seeds.

Increasing Pest and Disease Pressure

The Cotton Seed Treatment Market is also being driven by the rising pressure from pests and diseases that threaten cotton crops. The prevalence of pests such as boll weevils and various fungal diseases has necessitated the adoption of effective seed treatment solutions. In recent years, the incidence of these threats has increased, prompting farmers to seek reliable treatments to protect their crops. The market for pest control solutions in agriculture was estimated at 20 billion USD in 2023, indicating a substantial opportunity for the Cotton Seed Treatment Market to provide effective solutions that mitigate these risks.

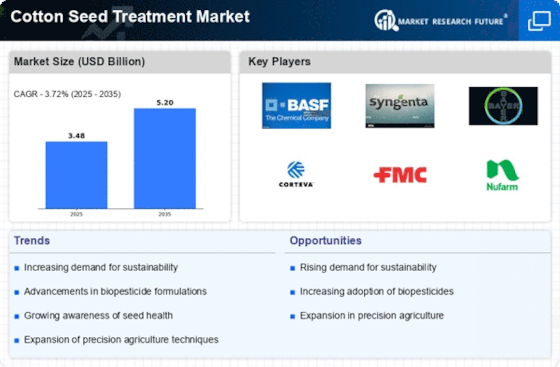

Advancements in Seed Treatment Technologies

Technological innovations in seed treatment are significantly influencing the Cotton Seed Treatment Market. The introduction of advanced formulations and application techniques enhances the efficacy of treatments against pests and diseases. For instance, the development of bio-based seed treatments is gaining traction, as they offer environmentally friendly alternatives to traditional chemical treatments. In 2023, the market for seed treatment technologies was valued at around 4 billion USD, with projections indicating a steady growth rate. These advancements not only improve seed germination rates but also contribute to higher crop yields, thus driving the demand for cotton seed treatments.

Growing Awareness of Integrated Pest Management

The concept of Integrated Pest Management (IPM) is gaining traction within the Cotton Seed Treatment Market. Farmers are increasingly adopting IPM strategies that combine biological, cultural, and chemical practices to manage pests sustainably. This holistic approach not only reduces reliance on chemical pesticides but also enhances the effectiveness of seed treatments. In 2023, the adoption of IPM practices in cotton farming was reported to be around 30%, reflecting a growing trend towards sustainable agriculture. As awareness of IPM continues to rise, the demand for innovative seed treatment solutions that align with these practices is likely to increase, further propelling the Cotton Seed Treatment Market.