Rising Demand for Cotton Products

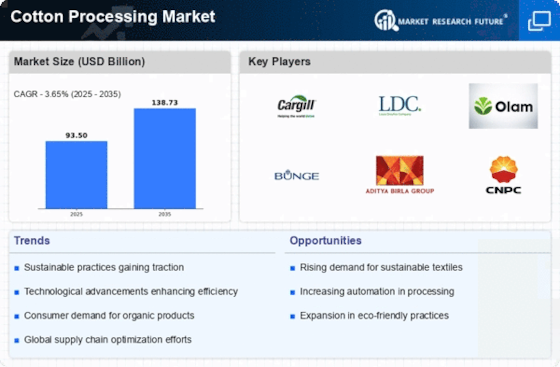

The cotton processing Market is experiencing a notable increase in demand for cotton-based products, driven by consumer preferences for natural fibers. As awareness of sustainability grows, many consumers are gravitating towards cotton due to its biodegradable properties. In 2025, the demand for cotton textiles is projected to rise by approximately 4% annually, indicating a robust market for cotton processing. This trend is further supported by the fashion industry's shift towards sustainable materials, which is likely to enhance the market's growth. Additionally, the increasing use of cotton in home furnishings and personal care products contributes to this rising demand, suggesting a favorable outlook for the Cotton Processing Market.

Expansion of Cotton Cultivation Areas

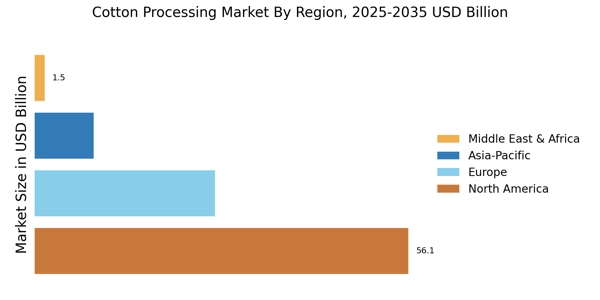

The expansion of cotton cultivation areas is a significant driver for the Cotton Processing Market, as it directly influences the availability of raw materials. Regions previously unsuitable for cotton farming are now being developed, thanks to advancements in agricultural technology and irrigation methods. This expansion is expected to increase cotton production by approximately 5% over the next few years, providing a steady supply for processing facilities. Additionally, the diversification of cotton varieties, including drought-resistant strains, is likely to enhance yield and quality. As more regions engage in cotton cultivation, the Cotton Processing Market stands to benefit from increased raw material availability, potentially leading to lower prices and higher production volumes.

Growing Awareness of Sustainable Practices

Sustainability has emerged as a pivotal driver in the Cotton Processing Market, influencing both production methods and consumer choices. As environmental concerns escalate, stakeholders are increasingly adopting sustainable practices, such as organic cotton farming and eco-friendly processing techniques. The market for organic cotton is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 10% in the coming years. This shift towards sustainability is not only appealing to environmentally conscious consumers but also aligns with regulatory pressures for greener production methods. Consequently, the Cotton Processing Market is likely to see a transformation as it adapts to these sustainable practices, enhancing its appeal and marketability.

Technological Innovations in Processing Techniques

Technological advancements are playing a crucial role in the Cotton Processing Market, enhancing efficiency and product quality. Innovations such as automated spinning and weaving technologies are streamlining production processes, reducing waste, and improving yield rates. For instance, the introduction of advanced ginning technologies has been shown to increase fiber quality while minimizing damage to the cotton. Furthermore, the integration of artificial intelligence and machine learning in processing operations is expected to optimize supply chain management and reduce operational costs. These technological improvements not only bolster productivity but also position the Cotton Processing Market to meet the evolving demands of consumers and manufacturers alike.

Increasing Investment in Cotton Processing Infrastructure

Investment in cotton processing infrastructure is a critical driver for the Cotton Processing Market, as it enhances production capabilities and efficiency. Governments and private entities are recognizing the importance of modernizing processing facilities to meet growing demand. In 2025, investments in processing technology and infrastructure are expected to rise significantly, with estimates suggesting an increase of around 15%. This influx of capital is likely to facilitate the adoption of state-of-the-art machinery and improve overall operational efficiency. Furthermore, enhanced infrastructure can lead to better supply chain management, reducing costs and improving product quality. As a result, the Cotton Processing Market is poised for growth, driven by these strategic investments.