Sustainability Initiatives

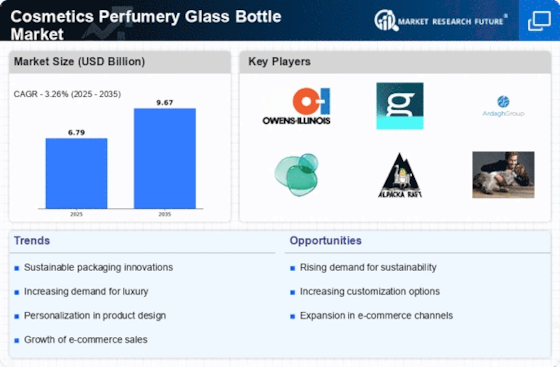

The cosmetics perfumery glass bottle Market is increasingly influenced by sustainability initiatives. Consumers are becoming more environmentally conscious, leading brands to adopt eco-friendly practices. This shift includes the use of recyclable materials and sustainable production methods. According to recent data, the demand for sustainable packaging solutions has surged, with a notable percentage of consumers willing to pay a premium for products that align with their values. As a result, companies are investing in research and development to create glass bottles that minimize environmental impact. This trend not only enhances brand loyalty but also positions companies favorably in a competitive market. The emphasis on sustainability is likely to drive growth in the Cosmetics Perfumery Glass Bottle Market, as brands that prioritize eco-friendly practices may capture a larger share of the market.

Growth of E-commerce Platforms

The Cosmetics Perfumery Glass Bottle Market is witnessing significant growth due to the rise of e-commerce platforms. The convenience of online shopping has transformed consumer purchasing behavior, allowing for greater access to a diverse range of products. Data indicates that e-commerce sales in the cosmetics sector have surged, with a substantial portion of consumers preferring to shop online for their beauty needs. This shift has prompted brands to enhance their online presence and optimize packaging for shipping, ensuring that glass bottles arrive intact. As e-commerce continues to expand, it is likely to drive demand for innovative packaging solutions that cater to online retail. The Cosmetics Perfumery Glass Bottle Market stands to benefit from this trend, as brands adapt to the evolving landscape of consumer preferences.

Rising Demand for Luxury Products

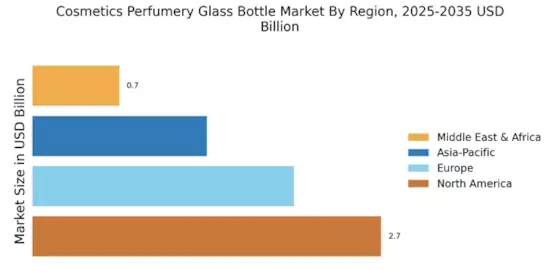

The Cosmetics Perfumery Glass Bottle Market is experiencing a notable rise in demand for luxury products. As disposable income increases in various regions, consumers are increasingly inclined to invest in high-end fragrances and cosmetics. This trend is reflected in the growing sales of premium glass bottles, which are often associated with luxury branding. Market data indicates that the luxury segment is expanding at a faster rate compared to mass-market products. Consequently, brands are focusing on creating aesthetically pleasing and high-quality glass bottles that enhance the overall consumer experience. This shift towards luxury is likely to propel the Cosmetics Perfumery Glass Bottle Market, as consumers seek products that not only deliver quality but also convey a sense of prestige.

Emergence of Niche Fragrance Brands

The Cosmetics Perfumery Glass Bottle Market is being shaped by the emergence of niche fragrance brands. These brands often focus on unique scent profiles and artisanal production methods, appealing to consumers seeking personalized experiences. Market data suggests that niche fragrances are gaining traction, with a growing number of consumers willing to explore unconventional scents. This trend has led to an increase in demand for distinctive glass bottle designs that reflect the brand's identity. As niche brands continue to proliferate, they are likely to influence the overall market dynamics, pushing established brands to innovate and differentiate their offerings. The Cosmetics Perfumery Glass Bottle Market may experience a shift as consumer preferences evolve towards more individualized and exclusive fragrance options.

Technological Advancements in Packaging

Technological advancements are playing a crucial role in shaping the Cosmetics Perfumery Glass Bottle Market. Innovations in glass manufacturing processes have led to the development of lighter, more durable bottles that maintain product integrity. Additionally, advancements in printing and labeling technologies allow for more intricate designs and branding opportunities. Market analysis suggests that these technological improvements are enhancing the appeal of glass bottles, making them a preferred choice among consumers. Furthermore, the integration of smart packaging solutions, such as QR codes and NFC technology, is emerging as a trend within the industry. These innovations not only improve user engagement but also provide brands with valuable consumer insights. As technology continues to evolve, it is likely to further influence the Cosmetics Perfumery Glass Bottle Market.