E-commerce Growth

The rapid growth of e-commerce is significantly impacting the Global Cosmetic Packaging Market Industry. As online shopping becomes more prevalent, brands are adapting their packaging to ensure safe and appealing delivery. This includes the use of protective packaging materials and designs that enhance the unboxing experience. Furthermore, e-commerce platforms often prioritize visually appealing packaging that can attract consumers' attention in a crowded digital marketplace. This shift is likely to drive market growth, as the industry adapts to the evolving retail landscape, contributing to the anticipated market value of 58.1 USD Billion in 2024.

Regulatory Compliance

Regulatory compliance is a critical driver in the Global Cosmetic Packaging Market Industry. Governments worldwide are implementing stringent regulations regarding packaging materials, labeling, and safety standards. Companies must navigate these regulations to ensure their products meet legal requirements, which can influence packaging design and materials used. For instance, regulations may mandate the use of specific recyclable materials or require clear labeling of ingredients. Compliance not only ensures market access but also builds consumer trust. As the industry adapts to these regulatory changes, it is likely to see a steady growth trajectory, contributing to the overall market expansion.

Sustainability Trends

The Global Cosmetic Packaging Market Industry is increasingly influenced by sustainability trends, as consumers demand eco-friendly packaging solutions. This shift is evident in the rising use of biodegradable materials and recyclable packaging. Companies are adopting sustainable practices to reduce their carbon footprint, which aligns with the global push for environmental responsibility. For instance, brands are exploring plant-based plastics and minimalistic designs that reduce material usage. This trend is expected to drive the market's growth, contributing to an estimated value of 58.1 USD Billion in 2024, as companies prioritize sustainability to meet consumer expectations.

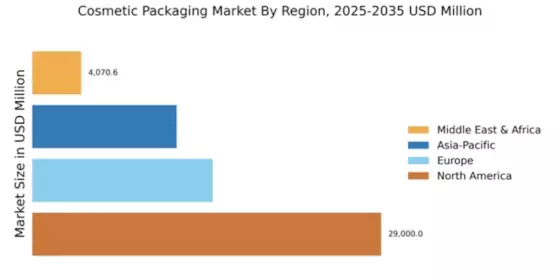

Market Growth Projections

The Global Cosmetic Packaging Industry is projected to experience substantial growth, with estimates indicating a market value of 33.4 USD Billion in 2024 and a potential increase to 53.6 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate (CAGR) of 4.4% from 2025 to 2035. Such projections highlight the increasing consumer demand for innovative and sustainable packaging solutions, as well as the industry's ability to adapt to changing market dynamics. The anticipated growth reflects broader trends in consumer preferences and technological advancements, positioning the industry for continued success.

Technological Advancements

Technological advancements play a pivotal role in shaping the Global Cosmetic Packaging Market Industry. Innovations such as smart packaging, which incorporates QR codes and NFC technology, enhance consumer engagement and provide information about product usage. Additionally, advancements in printing technology allow for high-quality graphics and customization options, appealing to a broader audience. These technologies not only improve the aesthetic appeal of packaging but also enhance functionality, such as tamper-proof seals and air-tight closures. As these innovations proliferate, they are likely to contribute to the market's projected growth, reaching 88.2 USD Billion by 2035.

Rising Demand for Premium Products

The Global Cosmetic Packaging Market Industry is witnessing a surge in demand for premium and luxury cosmetic products. Consumers are increasingly willing to invest in high-quality items that offer unique packaging experiences. This trend is particularly pronounced in the skincare and fragrance segments, where packaging serves as a key differentiator. Brands are responding by utilizing high-end materials and intricate designs that convey a sense of luxury. This shift towards premiumization is expected to bolster the market, as it aligns with the projected CAGR of 3.87% from 2025 to 2035, reflecting a growing consumer preference for premium offerings.