Customization Trends

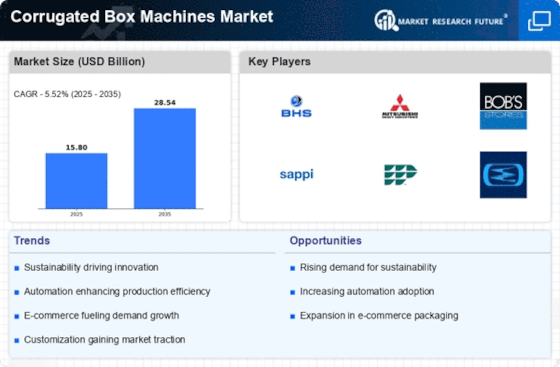

The growing trend towards customization is a notable driver for the Corrugated Box Machines Market. As brands seek to differentiate themselves in a crowded marketplace, the demand for tailored packaging solutions has increased. Custom corrugated boxes not only enhance brand visibility but also improve customer experience. In 2025, it is anticipated that a significant percentage of consumers will prefer personalized packaging options, prompting manufacturers to adapt their production processes accordingly. This shift is likely to lead to the development of more versatile corrugated box machines capable of producing a variety of sizes, shapes, and designs. The ability to offer customized solutions may provide manufacturers with a competitive advantage, thereby driving growth within the Corrugated Box Machines Market.

E-commerce Expansion

The rapid expansion of e-commerce is significantly influencing the Corrugated Box Machines Market. With online shopping becoming increasingly prevalent, the demand for packaging solutions that can withstand shipping and handling has intensified. In 2025, e-commerce sales are expected to account for a substantial portion of total retail sales, necessitating robust and reliable packaging. Corrugated boxes are favored for their durability and protective qualities, making them ideal for shipping various products. This trend has prompted manufacturers to invest in advanced corrugated box machines that can produce customized packaging solutions at scale. The ability to quickly adapt to changing consumer preferences and shipping requirements is likely to be a key factor in maintaining competitiveness within the Corrugated Box Machines Market.

Sustainability Initiatives

The increasing emphasis on sustainability is a pivotal driver for the Corrugated Box Machines Market. As businesses strive to reduce their carbon footprint, the demand for eco-friendly packaging solutions has surged. Corrugated boxes, being recyclable and biodegradable, align well with these sustainability goals. In fact, the corrugated packaging segment is projected to grow at a compound annual growth rate of approximately 4.5% over the next few years. This trend is further fueled by regulatory pressures and consumer preferences for environmentally responsible products. Manufacturers of corrugated box machines are thus innovating to produce more efficient and sustainable packaging solutions, which could enhance their market competitiveness. The shift towards sustainable practices not only benefits the environment but also opens new avenues for growth within the Corrugated Box Machines Market.

Technological Advancements

Technological advancements are reshaping the landscape of the Corrugated Box Machines Market. Innovations in automation, artificial intelligence, and machine learning are enhancing production efficiency and reducing operational costs. For instance, the integration of smart technologies allows for real-time monitoring and predictive maintenance, which can significantly minimize downtime. Furthermore, the introduction of high-speed corrugated box machines is enabling manufacturers to meet the increasing demand for packaging without compromising quality. As the industry evolves, companies that leverage these technological advancements are likely to gain a competitive edge. The ongoing investment in research and development is expected to drive further innovations, thereby expanding the capabilities of corrugated box machines and enhancing their appeal in the market.

Rising Demand in Emerging Markets

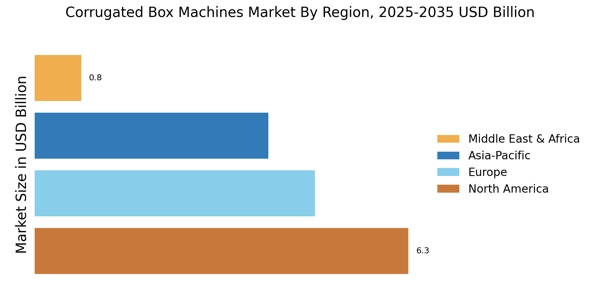

The rising demand for corrugated packaging in emerging markets is a crucial driver for the Corrugated Box Machines Market. As economies in these regions continue to develop, there is an increasing need for efficient packaging solutions across various sectors, including food and beverage, electronics, and consumer goods. The corrugated packaging market in these areas is projected to witness robust growth, driven by urbanization and changing consumer lifestyles. Manufacturers are likely to focus on expanding their production capabilities to cater to this burgeoning demand. Additionally, the entry of new players into the market may intensify competition, leading to further innovations in corrugated box machine technology. This trend suggests a promising outlook for the Corrugated Box Machines Market as it adapts to the evolving needs of emerging markets.