Research methodology on Corrugated Boxes Market

Introduction:

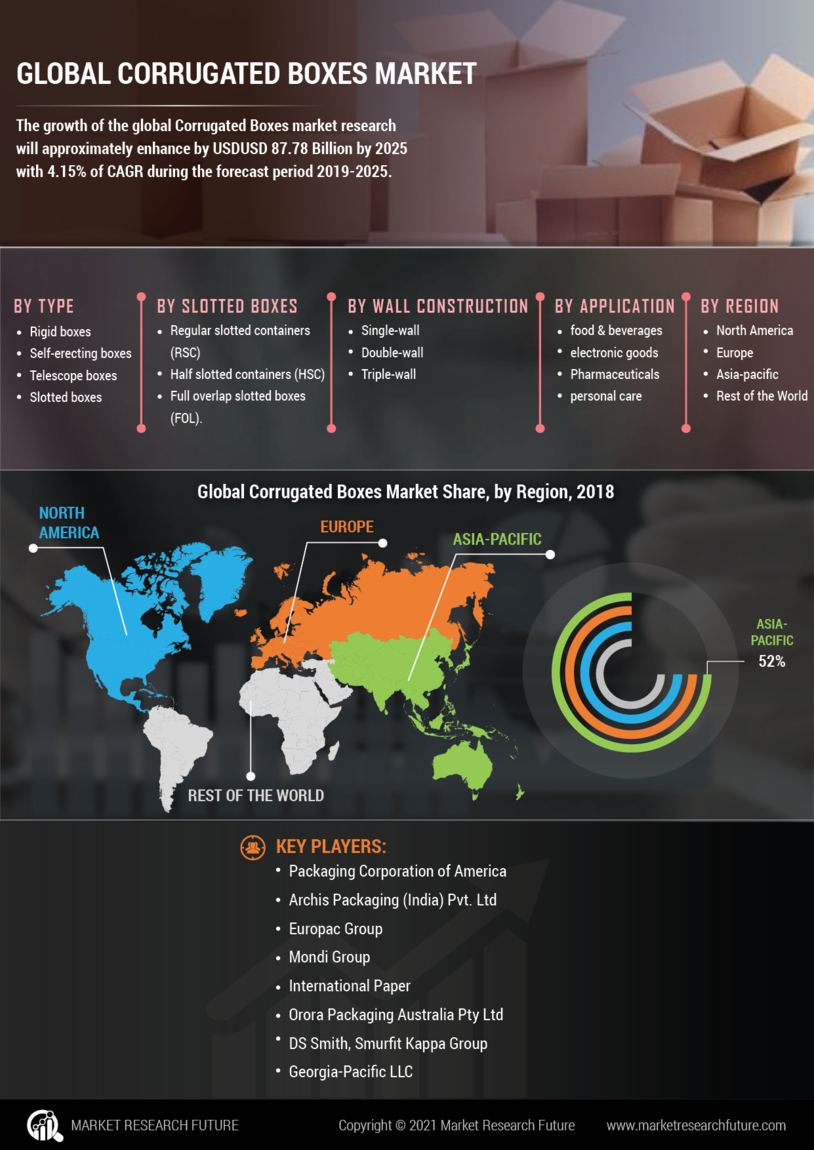

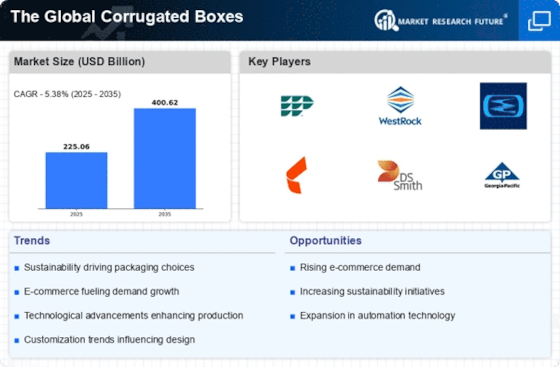

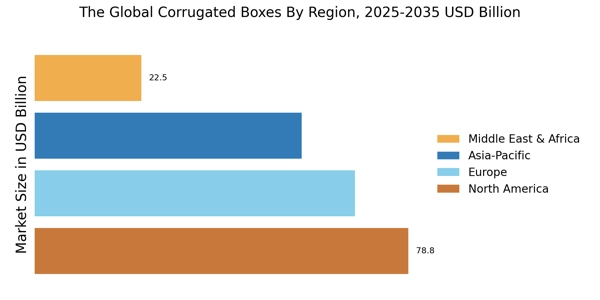

This research aims to analyze the market for corrugated boxes and their impact on the global supply chain. This report provides an in-depth analysis of the corrugated boxes market, by analyzing the driving forces leading to an increase in demand and the influence that technological advancements have had on product offerings. Moreover, the published research report by Market Research Future will provide a thorough evaluation of the impact that environmental regulations have had on the market in recent years. Additionally, the research also provides an in-depth review of the various pricing strategies adopted by leading players in the market, as well as their respective strategies for gaining an edge over competitors.

Research Objectives:

This research aims to explore the key factors influencing the global corrugated box market, in terms of drivers, restraints, and opportunities. Further, the research also focuses on exploring the current trends and forecasts of the global corrugated box market, in terms of revenue and volume.

To evaluate factors influencing the global corrugated boxes market

To understand the impact of technological advancements, packaging regulations & consumer preferences on the global corrugated boxes market

To assess the current trends and forecast of the global corrugated boxes market

To determine the pricing strategies adopted by leading players in the market

To analyze strategies adopted by leading players for gaining an edge over competitors

Research Methodology:

The research approach adopted for creating the research report is based on a combination of primary and secondary research methods. MRFR's research work starts by gathering information from credible secondary sources, such as annual reports, industry reports, press releases, white papers, trade journals and government databases. After that, the identification of the market drivers, restraints and trends, are analyzed by the arguments to support the conclusions. Additionally, we carried out interviews with industry experts and surveyed our clients to obtain their insights into the market.

- Primary Data Collection & Analysis Methodology:

Primary data sourced from interviews with industry experts includes information on the current state of the market, expected trends for the future, and overall opinions about the industry. All stakeholders interviewed are asked an identical set of questions which are verified and transcribed, before being analysed using statistical methods and software.

- Secondary Data Collection & Analysis Methodology:

MRFR used a range of secondary sources to obtain data for the research, including industry journals, websites, trade association materials and published reports. Additionally, MRFR gathered market data from sources such as statistics from the World Bank and the United Nations, and business information from market research firms, magazines and other sources. After gathering the data, an extensive assessment of the data, including an analysis of trends, patterns, relationships and outliers is conducted.

Given the complexity of the subject matter, MRFR employed the following methods for data analysis:

Explorative data analysis: to explore the trends in the global corrugated boxes market.

Descriptive data analysis: to estimate the size of the global market and identify key growth segments.

Predictive data analysis: to assess market trends and make forecasts.

Validity and Reliability:

Several steps were taken to ensure that our research data is both reliable and valid. The steps taken in this regard include:

Ensuring that primary data is gathered using robust techniques such as face-to-face and telephone interviews.

Verifying the credentials of the sources to ensure that only reliable sources of information were considered.

Cross-checking the research results with industry experts to ensure that the findings are reliable.

Carrying out pre-testing of the questions before the interviews to ensure the accuracy of the results.