Research Methodology on Contract Management Market

Introduction

The Contract Management Market report commissioned by Market Research Future (MRFR) seeks to provide a comprehensive overview of the market. The report attempts to give due insights into the various determinants that the market carries, such as the drivers and restraints, opportunities, challenges and trends that have been witnessed throughout the course of the given period. The report provides an up-to-date analysis of the ever-changing and dynamic conditions within the Contract Management Industry. The report is compiled using and analyzing a mix of primary and secondary data, both qualitative as well as quantitative.

Research Objectives

The research objectives of the report, are as follows:

- To provide a thorough understanding, analysis and forecast of the Contract Management Market.

- To provide historical and forecast revenue of the segments and market as a whole.

- To provide a detailed analysis of the market structure along with the forecast of various segments and sub-segments of the Contract Management Market.

- To provide regional-level analysis with forecasts of segments and sub-segments.

- To provide a detailed analysis of different drivers, restraints, opportunities, and challenges of the Contract Management Market.

- To analyse the key players in the Contract Management Market.

- To provide detailed company profiles of the key players with their strategic developments.

Research Methodology

In order to collate data for all aspects of the report, the following research methodology is conducted:

Data Source

The data used in the report is derived from various primary and secondary sources. The primary data sources include interviews with the decision makers, industry executives and professionals such as portfolio managers, and experts from related industries. The secondary sources include company websites, magazines, trade journals, industry associations and associations, financial data and annual reports of the company, databases and white papers etc.

Primary Research

The primary research process involves interviewing several industry experts and stakeholders operating in the Contract Management Market. Interviews are conducted through telephonic conversations and questionnaires are also sent via email to get responses from industry experts across all key global markets.

Secondary Research

The secondary research process includes an in-depth study of the data that is obtained from the primary research and published information. These include company annual reports, industry magazines, journals and other sources.

Research Tools

In the process of the study, MRFR utilizes several research tools that help us in gathering and analyzing the data obtained from primary as well as secondary sources. These include SWOT analysis, Porter’s Five Forces analysis, market attractiveness analysis and pricing analysis.

Assumptions

The assumptions considered during the research process involve analysis of the data obtained from primary sources and the utilization of the market information available from secondary sources. Furthermore, the recent market developments, growth opportunities and regulatory framework are taken into consideration.

Market Structure

The Contract Management market is segmented based on type, end user and region.

1. By Type:

2. By End User:

3. By Region:

- North America

- Europe

- Asia Pacific

- Rest of the World (RoW)

Regional Analysis

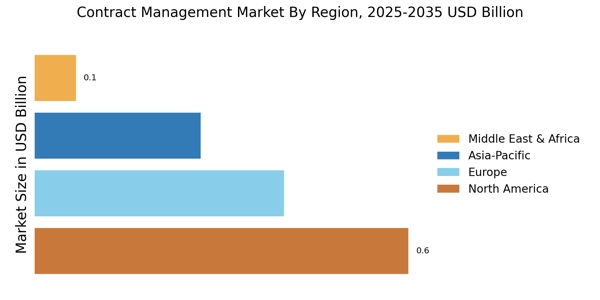

The report covers a detailed market analysis for the region of North America, Europe, Asia Pacific, the Middle East and Africa and the Rest of the World (RoW).

Competitive Landscape

The report covers a brief profiling of some of the key players in the Contract Management Market. These include Apttus Corporation (US), Agiloft Inc. (US), SAP SE (Germany), IBM Corporation (US), Oracle Corporation (US), Icertis (India), Adobe Systems Incorporated (US), Exari (US), Bottomline Technologies (US), ContractLogix (US) and TraceTek (US).

Conclusion

The published research report, titled “Contract Management Market” provides thoroughly researched data on a range of facets that encompass the dynamics of the market such as market drivers, trends, opportunities, restraints etc. Furthermore, it gives an extensive overview of the ongoing market conditions and a comprehensive analysis of the underlying forces or factors that are expected to shape the trajectory of the market in the forecast period.