E-commerce Growth

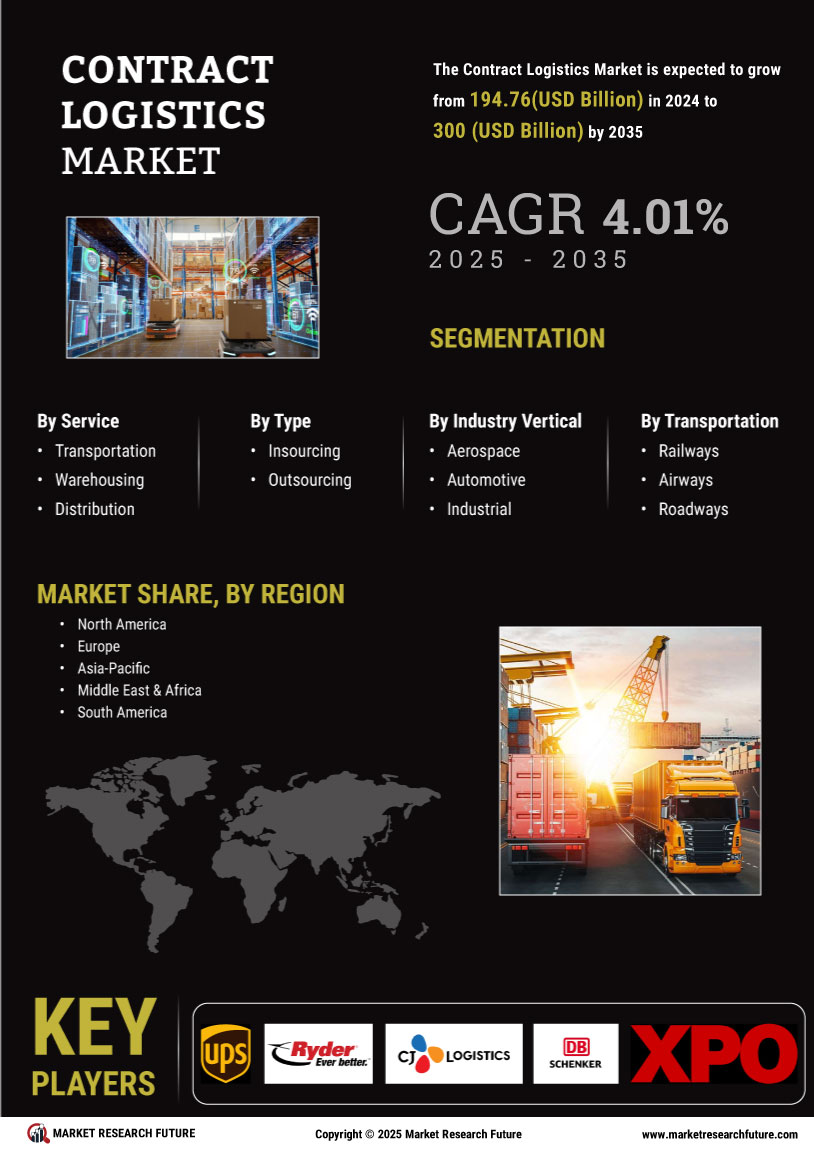

The rapid expansion of the e-commerce sector is a primary driver of the Global Contract Logistics Market Industry. As consumers increasingly prefer online shopping, businesses are compelled to enhance their logistics capabilities to meet rising demand. In 2024, the market is valued at 194.8 USD Billion, reflecting the necessity for efficient warehousing and distribution networks. Companies are investing in advanced technologies and logistics solutions to streamline operations and improve customer satisfaction. This trend is expected to continue, with projections indicating a market size of 300 USD Billion by 2035, highlighting the critical role of contract logistics in supporting e-commerce growth.

Global Trade Dynamics

Shifts in global trade patterns significantly influence the Global Contract Logistics Market Industry. As countries engage in trade agreements and tariffs evolve, logistics providers must adapt their strategies to navigate these complexities. The increasing interconnectedness of markets necessitates robust logistics solutions to facilitate the movement of goods across borders. For example, the rise of trade between Asia and North America has prompted logistics firms to enhance their capabilities in these regions. This dynamic environment is expected to drive the market's growth, contributing to the projected increase from 194.8 USD Billion in 2024 to 300 USD Billion by 2035.

Sustainability Initiatives

The growing emphasis on sustainability is a notable driver of the Global Contract Logistics Market Industry. Companies are increasingly prioritizing environmentally friendly practices in their logistics operations, such as reducing carbon emissions and optimizing transportation routes. This shift is not only driven by regulatory requirements but also by consumer preferences for sustainable products and services. Logistics providers are investing in green technologies and practices, which can lead to cost savings and improved brand reputation. As sustainability becomes a core component of business strategy, the contract logistics market is likely to expand, aligning with broader environmental goals.

Technological Advancements

Technological innovations are reshaping the Global Contract Logistics Market Industry, enabling companies to optimize their supply chain operations. The integration of automation, artificial intelligence, and data analytics enhances efficiency and reduces operational costs. For instance, automated warehousing solutions allow for faster order fulfillment and inventory management. As businesses adopt these technologies, they can respond more effectively to market demands. The anticipated compound annual growth rate of 4.01% from 2025 to 2035 indicates a strong correlation between technology adoption and market growth, as firms leverage these advancements to gain competitive advantages in logistics.

Consumer Demand for Customization

The rising consumer demand for personalized products and services is reshaping the Global Contract Logistics Market Industry. As customers seek tailored solutions, logistics providers are required to develop flexible and responsive supply chains. This trend necessitates advanced logistics capabilities, including real-time tracking and inventory management systems. Companies that can offer customized logistics solutions are likely to gain a competitive edge in the market. The anticipated growth from 194.8 USD Billion in 2024 to 300 USD Billion by 2035 underscores the importance of adaptability in logistics, as businesses strive to meet evolving consumer expectations.