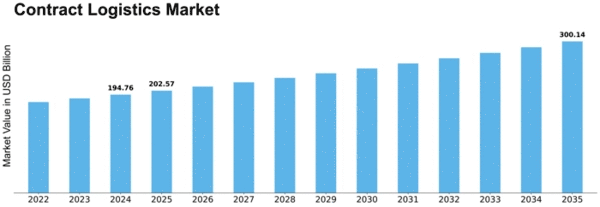

Contract Logistics Size

Contract Logistics Market Growth Projections and Opportunities

The contract logistics market is intricately shaped by numerous market parameters that determine its development trajectory and overall development. From the changing e-commerce landscape to the impact of technological advances, these parameters combine to play an important role in defining contract exports. The tremendous development in e-commerce is a general propeller of the contract products market. As users progressively turn to online shopping, businesses need effective and accessible logistics solutions to handle inventory, order satisfaction, and last-mile delivery. The expanding global supply chain is thrusting demand for subcontracting contracts. Enterprises are looking for logistics allies who can handle international regulations, handle complicated supply chains, and ensure the smooth flow of goods across borders. Technological advances, including artificial intelligence, automation, and data analytics, are having a meaningful impact on the contract logistics market. Automation in predictive analytics, warehouses, demand prediction, and real-time monitoring solutions obviously make logistics processes more productive and transparent. The needs of industries such as pharmaceutical, healthcare, and perishables are driving demand for specialty exports. Temperature preservation, maintenance, and value creation are needed in some areas. By providing tailored solutions for specific services, shippers are taking advantage of the growing demand for specialized services, creating unique market opportunities. Increased awareness of environmental sustainability affects the contract export market. The industry is being encouraged to adopt environmentally friendly practices and reduce its carbon footprint in logistics. Contract exporters who prioritize sustainability, energy-efficient technology, and environmentally friendly packaging are corporate social responsibility in line with the increasing emphasis on environmental stewardship. The ability to provide flexible and scalable logistics solutions is prime in the contract logistics market. Businesses need partners who can adapt to changes in demand, seasonal changes, and unforeseen challenges. By providing customizable solutions and scalability, logistics providers help customers manage their freight costs while essentializing operational agility. The complexity of international trade comes with a variety of regulations and compliance requirements. Contract carriers play a prime role in navigating these challenges, ensuring that shipments comply with local and global regulations. Effective risk management, including planning for crises such as natural disasters or geopolitical events, is essential for contract suppliers to preserve the reliability of their services.

Leave a Comment