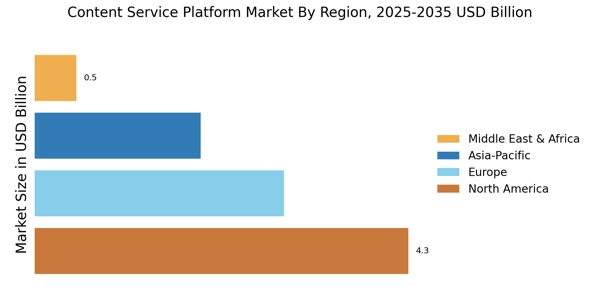

North America : Digital Transformation Leader

North America is the largest market for Content Service Platforms, holding approximately 45% of the global share. The region's growth is driven by rapid digital transformation, increasing demand for cloud-based solutions, and stringent data compliance regulations. The U.S. leads this market, followed closely by Canada, which contributes around 15% to the overall market share. Regulatory catalysts, such as the CCPA, further enhance the demand for secure content management solutions.

The competitive landscape in North America is robust, featuring key players like Microsoft, IBM, and Oracle. These companies are investing heavily in innovation and partnerships to enhance their offerings. The presence of advanced technological infrastructure and a high adoption rate of digital solutions among enterprises solidify North America's position as a leader in the Content Service Platform Market. Companies are also focusing on AI and machine learning to improve service delivery.

Europe : Emerging Regulatory Frameworks

Europe is the second-largest market for Content Service Platforms, accounting for approximately 30% of the global market share. The region's growth is fueled by increasing regulatory requirements, such as GDPR, which necessitate robust content management solutions. Countries like Germany and the UK are at the forefront, contributing significantly to the market. The demand for secure and compliant content services is driving innovation and investment in this sector.

Leading countries in Europe include Germany, the UK, and France, with major players like SAP and Adobe establishing a strong foothold. The competitive landscape is characterized by a mix of established firms and emerging startups, all vying for market share. The focus on data privacy and security is reshaping the content service landscape, prompting companies to enhance their offerings to meet regulatory standards. This dynamic environment fosters innovation and collaboration among industry players.

Asia-Pacific : Rapid Digital Adoption

Asia-Pacific is witnessing rapid growth in the Content Service Platform Market, holding approximately 20% of the global share. The region's expansion is driven by increasing digitalization, a growing number of SMEs adopting cloud solutions, and government initiatives promoting technology adoption. Countries like China and India are leading this growth, with significant investments in digital infrastructure and services, contributing to a vibrant market landscape.

The competitive environment in Asia-Pacific is diverse, with both local and international players competing for market share. Key players include Oracle and Adobe, alongside emerging local firms. The region's unique challenges, such as varying regulatory environments and cultural differences, are shaping the strategies of companies operating here. As digital transformation accelerates, the demand for innovative content service solutions is expected to rise, further solidifying Asia-Pacific's position in the global market.

Middle East and Africa : Untapped Market Potential

The Middle East and Africa region is gradually emerging in the Content Service Platform Market, currently holding about 5% of the global share. The growth is driven by increasing internet penetration, mobile device usage, and a rising focus on digital transformation across various sectors. Countries like South Africa and the UAE are leading this growth, with government initiatives aimed at enhancing digital infrastructure and services.

The competitive landscape in this region is still developing, with a mix of local and international players. Companies are beginning to recognize the potential of content services, leading to increased investments and partnerships. The presence of key players is growing, but challenges such as regulatory hurdles and varying levels of technological adoption remain. As the market matures, opportunities for growth and innovation are expected to expand significantly.