Market Analysis

In-depth Analysis of Content Intelligence Market Industry Landscape

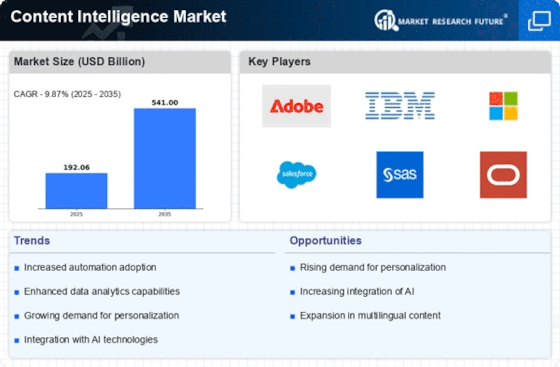

The dynamics involved market wise within the content intelligence market reveal its importance in extracting what is meaningful out of vast volumes of digital content. The definition of CI ranges from making use advanced technologies such as Natural Language Processing (NLP), Machine learning (ML) and Artificial Intelligence (AI) in analyzing unstructured data so as to obtain actionable information from it. Over time people have relied on digital contents found within different fields making provision for this rapid growth being one of the key factor driving this market.

Integration of Content Intelligence with CRM systems and marketing automation solutions is changing their landscapes. In effect, by merging into prevailing CRM platforms these instruments ensure comprehensive monitoring of client behaviors and preferences. It empowers companies on customer segmentation, lead scoring, as well as personalized approaches towards communication. For instant in case of marketing automation, it enables optimizing content delivery, automating content recommendations while evaluating effectiveness of marketing campaigns through Content Intelligence. Another aspect affecting market dynamics within the Content Intelligence industry is the need for effective categorization and tagging of content as well as managing metadata efficiently. Organizing and classifying a great deal of digital information may difficult if not impossible given that it grows continuously. With machine learning algorithms these applications are able to classify automatically which make them helpful for quickly finding exact data needed by users. Such capability becomes valuable especially in industries where compliance, data governance and efficient access to contents are important concerns.’

The growth in significance of sentiment analysis and emotion recognition is affecting the market dynamics in Content Intelligence space. Organizations are increasingly becoming aware of the need to understand sentiments and emotions that users express in digital content such as social media, customer reviews, and support interactions. Businesses deploying content intelligence tools with sentiment analysis capability can monitor public opinion, identify potential issues and align their responses based on client feelings.

Also, business intelligence (BI) and analytics platforms have been integrated with content intelligence influencing market dynamics. Content Intelligence combined with traditional BI Tools allows organizations to gain a comprehensive understanding of structured as well as unstructured data. This integration enables richer insights, trend analysis, strategic decision-making rooted in a holistic view of data. Merging Content Intelligence with BI approaches has led to more data-driven analytics which drive insight from disparate sources for businesses.

Leave a Comment