Emergence of Wearable Technology

The rise of wearable technology is significantly influencing the Consumer Electronics Optoelectronic Market. Devices such as smartwatches, fitness trackers, and augmented reality glasses are increasingly incorporating optoelectronic components to enhance functionality and user experience. This trend is supported by market data indicating that the wearable technology sector is projected to grow at a compound annual growth rate of over 20% in the coming years. As consumers seek more integrated and interactive experiences, the demand for optoelectronic components that support advanced features, such as health monitoring and real-time data display, is likely to increase. This shift not only reflects changing consumer preferences but also presents substantial opportunities for innovation within the Consumer Electronics Optoelectronic Market.

Expansion of Internet of Things (IoT)

The integration of the Internet of Things (IoT) into consumer electronics is reshaping the landscape of the Consumer Electronics Optoelectronic Market. IoT devices, which often rely on optoelectronic components for functionality, are becoming increasingly prevalent in households and businesses. This expansion is indicative of a broader trend towards smart homes and connected devices, where optoelectronic sensors and displays play a crucial role. Market data suggests that the number of connected devices is expected to reach over 30 billion by 2025, creating substantial opportunities for optoelectronic manufacturers. As consumers embrace smart technology, the demand for optoelectronic components that facilitate connectivity and enhance user interaction is likely to rise, driving growth in the industry.

Increased Focus on Sustainable Solutions

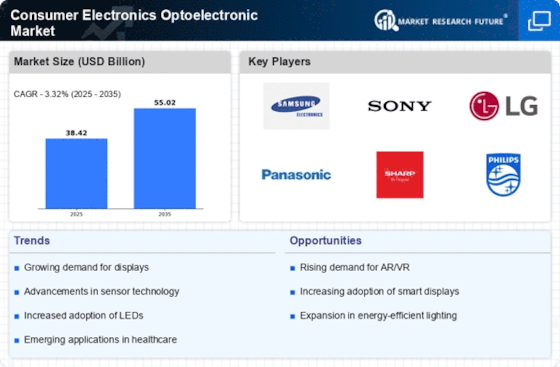

Sustainability is becoming a central theme within the Consumer Electronics Optoelectronic Market, as both consumers and manufacturers prioritize eco-friendly solutions. The demand for energy-efficient products is on the rise, with consumers increasingly aware of their environmental impact. This shift is prompting manufacturers to develop optoelectronic devices that consume less power and utilize sustainable materials. Market Research Future indicates that energy-efficient lighting solutions, such as LED technology, are expected to dominate the market, with a projected growth rate of approximately 10% annually. This focus on sustainability not only meets consumer expectations but also aligns with regulatory pressures aimed at reducing carbon footprints. As a result, the Consumer Electronics Optoelectronic Market is likely to see a transformation towards greener technologies.

Rising Demand for High-Performance Displays

The Consumer Electronics Optoelectronic Market is experiencing a notable surge in demand for high-performance displays, driven by advancements in technology and consumer preferences. As consumers increasingly seek superior visual experiences, manufacturers are compelled to innovate. The market for display technologies, including OLED and microLED, is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 15% in the coming years. This trend is further fueled by the proliferation of smart devices, which require enhanced display capabilities. Consequently, companies are investing heavily in research and development to create displays that offer better color accuracy, brightness, and energy efficiency. This focus on high-performance displays not only enhances user experience but also positions the Consumer Electronics Optoelectronic Market for sustained growth.

Technological Advancements in Sensor Technologies

The Consumer Electronics Optoelectronic Market is witnessing rapid advancements in sensor technologies, which are integral to the functionality of modern devices. Innovations in optoelectronic sensors, such as image sensors and photodetectors, are enhancing the capabilities of consumer electronics. These advancements are driven by the increasing demand for features like facial recognition, augmented reality, and enhanced imaging in smartphones and cameras. Market data suggests that the sensor market is expected to grow at a compound annual growth rate of around 12% over the next few years. This growth is indicative of the rising importance of sensor technologies in delivering superior user experiences. As manufacturers continue to invest in cutting-edge sensor technologies, the Consumer Electronics Optoelectronic Market is poised for significant evolution.