Increasing Adoption of Electric Vehicles

The increasing adoption of electric vehicles (EVs) is a pivotal driver for the Automotive Optoelectronic Market. As the automotive landscape shifts towards electrification, the demand for advanced optoelectronic components, such as battery management systems and energy-efficient lighting, is expected to rise. Data indicates that The Automotive Optoelectronic is projected to grow at a CAGR of around 20% through the next decade. This growth is accompanied by a heightened focus on sustainability and reducing carbon emissions, prompting manufacturers to invest in innovative optoelectronic solutions that enhance vehicle performance and efficiency. Consequently, the rise of EVs is likely to create new opportunities for optoelectronic technologies within the automotive sector.

Rising Demand for Enhanced Safety Features

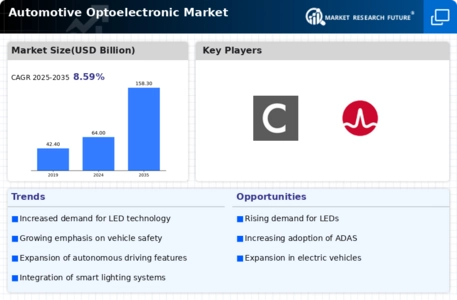

The Automotive Optoelectronic Market is experiencing a notable surge in demand for enhanced safety features in vehicles. This trend is largely driven by increasing consumer awareness regarding road safety and the implementation of stringent regulations by authorities. Advanced optoelectronic systems, such as adaptive headlights and advanced driver-assistance systems (ADAS), are becoming essential components in modern vehicles. According to recent data, the market for automotive safety systems is projected to grow at a compound annual growth rate (CAGR) of approximately 8% over the next five years. This growth is indicative of a broader shift towards integrating sophisticated technologies that improve visibility and reduce accident rates, thereby reinforcing the importance of optoelectronic solutions in the automotive sector.

Integration of Autonomous Driving Technologies

The integration of autonomous driving technologies is reshaping the Automotive Optoelectronic Market. As manufacturers strive to develop fully autonomous vehicles, the demand for sophisticated optoelectronic systems, including LiDAR, cameras, and sensors, is escalating. These technologies are crucial for enabling vehicles to perceive their environment and make informed driving decisions. Market analysis suggests that the autonomous vehicle segment could witness a growth rate exceeding 15% annually in the coming years. This trend underscores the necessity for advanced optoelectronic components that facilitate safe and reliable autonomous driving experiences. As such, the automotive industry is increasingly prioritizing the development and integration of these technologies.

Technological Advancements in Lighting Solutions

Technological advancements in lighting solutions are significantly influencing the Automotive Optoelectronic Market. Innovations such as LED and laser lighting technologies are not only enhancing vehicle aesthetics but also improving energy efficiency and performance. The transition from traditional halogen lights to advanced lighting systems is expected to drive market growth, with LED lighting expected to account for over 60% of the automotive lighting market by 2026. These advancements allow for better illumination, longer lifespan, and reduced energy consumption, which are critical factors for manufacturers aiming to meet consumer expectations and regulatory standards. As a result, the integration of cutting-edge lighting technologies is becoming a focal point for automotive manufacturers, further propelling the optoelectronic market.

Growing Focus on Vehicle Aesthetics and Customization

The growing focus on vehicle aesthetics and customization is emerging as a significant driver in the Automotive Optoelectronic Market. Consumers are increasingly seeking personalized features that enhance the visual appeal of their vehicles, leading to a rise in demand for innovative lighting solutions and customizable optoelectronic components. This trend is reflected in the increasing popularity of ambient lighting and dynamic lighting systems, which allow for greater personalization. Market data indicates that the automotive lighting segment is expected to reach a valuation of over 30 billion by 2027, driven by consumer preferences for unique and stylish vehicle designs. Consequently, manufacturers are compelled to invest in optoelectronic technologies that cater to these evolving consumer demands.