North America : Market Leader in Construction

North America is poised to maintain its leadership in the Construction Material Sourcing and Supply Chain Services Market, holding a market size of $12.9 billion in 2025. Key growth drivers include robust infrastructure investments, a booming housing market, and increasing demand for sustainable building materials. Regulatory support for green construction practices further fuels this growth, making the region a focal point for innovation and efficiency in supply chains.

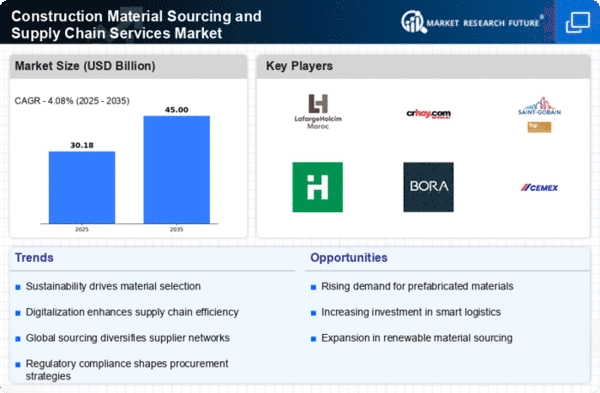

The competitive landscape is characterized by major players such as LafargeHolcim, Martin Marietta Materials, and Vulcan Materials Company. The U.S. leads the market, driven by significant construction activities in both residential and commercial sectors. The presence of established companies ensures a steady supply of materials, while ongoing mergers and acquisitions enhance market dynamics, positioning North America as a hub for construction material sourcing.

Europe : Sustainable Growth Initiatives

Europe's Construction Material Sourcing and Supply Chain Services Market is projected to reach $8.7 billion by 2025, driven by stringent environmental regulations and a strong push towards sustainability. The European Union's Green Deal and various national initiatives promote eco-friendly construction practices, significantly influencing demand trends. The region's commitment to reducing carbon emissions is a key catalyst for growth, encouraging innovation in material sourcing and supply chain efficiency.

Leading countries such as Germany, France, and the UK dominate the market, with key players like Saint-Gobain and HeidelbergCement at the forefront. The competitive landscape is marked by a focus on sustainable practices, with companies investing in green technologies and materials. This shift not only enhances market competitiveness but also aligns with consumer preferences for environmentally responsible construction solutions.

Asia-Pacific : Emerging Market Potential

The Asia-Pacific region is witnessing rapid growth in the Construction Material Sourcing and Supply Chain Services Market, projected to reach $5.8 billion by 2025. Key growth drivers include urbanization, population growth, and increased infrastructure spending, particularly in countries like China and India. Government initiatives aimed at enhancing infrastructure and housing development are pivotal in shaping demand trends, making the region a hotspot for construction activities.

China and India are the leading countries in this market, with significant investments in construction projects. The competitive landscape features key players such as Boral and Cemex, who are expanding their operations to meet the rising demand. The presence of a diverse range of suppliers and manufacturers enhances market dynamics, fostering innovation and efficiency in sourcing and supply chain services across the region.

Middle East and Africa : Resource-Rich Opportunities

The Middle East and Africa region is emerging as a significant player in the Construction Material Sourcing and Supply Chain Services Market, with a projected size of $1.6 billion by 2025. Key growth drivers include rapid urbanization, infrastructural development, and government investments in mega projects. The region's rich natural resources and strategic location further enhance its potential as a sourcing hub for construction materials, catering to both local and international markets.

Countries like the UAE and South Africa are leading the charge, with substantial investments in construction and infrastructure projects. The competitive landscape is characterized by a mix of local and international players, including companies like Kingspan Group. The focus on sustainable construction practices is gradually gaining traction, aligning with global trends and enhancing the region's attractiveness for investment in construction material sourcing.