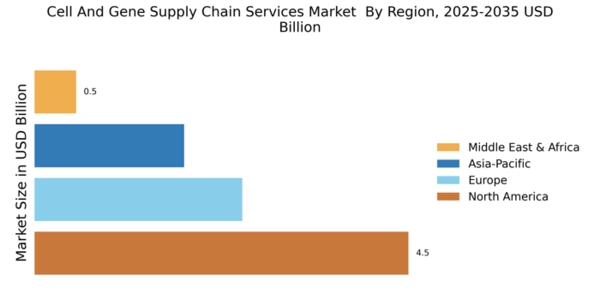

North America : Market Leader in Innovation

North America is poised to maintain its leadership in the Cell and Gene Supply Chain Services market, holding a significant market share of $4.5B in 2025. The region benefits from robust investment in biotechnology and healthcare, driven by increasing demand for personalized medicine and advanced therapies. Regulatory support from agencies like the FDA further catalyzes growth, ensuring a streamlined approval process for innovative treatments.

The competitive landscape is characterized by key players such as Thermo Fisher Scientific, Catalent, and KBI Biopharma, which are leveraging cutting-edge technologies to enhance service offerings. The U.S. remains the largest market, with Canada also showing promising growth. The presence of established companies and a strong research infrastructure positions North America as a hub for advancements in cell and gene therapies.

Europe : Emerging Market with Growth Potential

Europe is witnessing a significant rise in the Cell and Gene Supply Chain Services market, projected to reach $2.5B by 2025. The region's growth is fueled by increasing investments in research and development, alongside supportive regulatory frameworks from the European Medicines Agency (EMA). The demand for innovative therapies is on the rise, driven by a growing aging population and the prevalence of chronic diseases.

Leading countries such as Germany, the UK, and Switzerland are at the forefront of this expansion, hosting major players like Lonza and Merck KGaA. The competitive landscape is evolving, with a focus on collaboration between biotech firms and academic institutions. This synergy is expected to enhance the development and distribution of advanced therapies across Europe.

Asia-Pacific : Rapidly Growing Market Dynamics

Asia-Pacific is emerging as a dynamic player in the Cell and Gene Supply Chain Services market, with a projected size of $1.8B by 2025. The region's growth is driven by increasing healthcare expenditure, a rising patient population, and advancements in biotechnology. Countries like China and Japan are leading the charge, supported by favorable government policies aimed at enhancing healthcare infrastructure and innovation.

The competitive landscape features key players such as WuXi AppTec and Fujifilm Diosynth Biotechnologies, which are expanding their capabilities to meet the growing demand for cell and gene therapies. The region's focus on research and development, coupled with a growing number of clinical trials, positions Asia-Pacific as a critical market for future advancements in this sector.

Middle East and Africa : Emerging Market with Challenges

The Middle East and Africa region is in the nascent stages of developing its Cell and Gene Supply Chain Services market, estimated at $0.5B by 2025. Growth is hindered by infrastructural challenges and limited access to advanced healthcare technologies. However, increasing investments in healthcare and biotechnology are beginning to reshape the landscape, driven by a rising demand for innovative treatments and therapies.

Countries like South Africa and the UAE are making strides in establishing a regulatory framework to support the growth of this sector. The presence of local and international players is gradually increasing, with a focus on building partnerships to enhance service delivery. As the region continues to develop, it holds potential for significant growth in the coming years.