Market Analysis

In-depth Analysis of Construction Estimate Software Market Industry Landscape

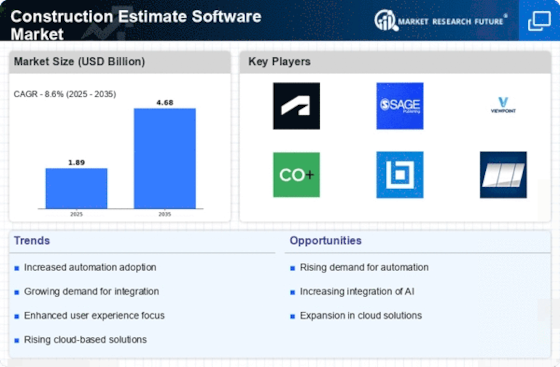

The increasing demand for efficient project management tool in construction has led to significant growth within The Construction Estimate Software market in recent years.Global competitiveness has led many companies to look for ways of improving efficiency while maintaining high levels of productivity within their organizations.Construction estimation software dynamics are shaped by different factors that affect adoption rates among users.

One major driver of market dynamics is the growing complexity of construction projects. The need has grown for sophisticated tools to address complex calculations such as material costs, labor expenses and project timelines as construction projects become more intricate. Through the use of this software, accurate and comprehensive estimates are made possible thus enabling better planning and management by constructions companies.

Also, the industry’s focus on cost efficiency and resource optimization has prompted a switch to construction estimate software.The significance of accurate cost estimation in preventing budget overruns and ensuring profitability is now being appreciated by firms.Construction estimate software plays an important role in allowing organizations to develop detailed estimates that reduce chances of encountering unexpected costs during the project life cycle.

Another factor impacting market dynamics is improvement in technology within the field of construction management.Cloud computing has transformed how construction estimation software works while artificial intelligence among others have done so by transforming its capabilities.Cloud based systems enable real-time collaborations as well as access from different locations thereby enhancing seamless communication between various stakeholders involved in a particular project.Artificial intelligence helps in improving accuracy of estimates by evaluating historical data looking at past trends hence predicting possible budgets variations.

Further, increased awareness on sustainability issues and green building practices within the building industry has led to integration with Construction estimate software.Some features have been introduced into such software which allows for an examination into whether or not specific buildings will meet environmental requirements i.e. materials procurement, energy consumption and waste disposal.This is consistent with industries commitment towards sustainable and environmentally friendly construction practices.

Moreover, many companies offer a wide range of construction estimate software so that the competitive landscape shapes market dynamics. This has led to continuous innovation, leading to feature-rich and user-friendly software. Construction firms are focusing on customization options, scalability issues and integration capabilities to meet the diverse needs in the industry.

Leave a Comment