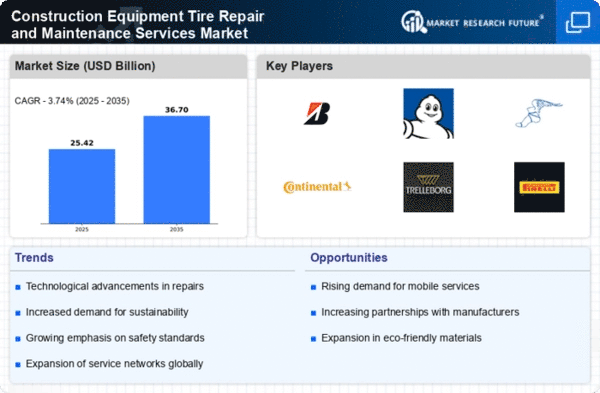

The Construction Equipment Tire Repair and Maintenance Services Market is currently characterized by a dynamic competitive landscape, driven by factors such as technological advancements, increasing demand for efficient machinery, and a growing emphasis on sustainability. Major players like Bridgestone (JP), Michelin (FR), and Goodyear (US) are strategically positioning themselves through innovation and partnerships. Bridgestone (JP) focuses on enhancing its tire technology to improve durability and performance, while Michelin (FR) emphasizes sustainability through eco-friendly tire solutions. Goodyear (US) is actively pursuing digital transformation initiatives to optimize service delivery and customer engagement, collectively shaping a competitive environment that prioritizes technological integration and environmental responsibility.In terms of business tactics, companies are increasingly localizing manufacturing to reduce lead times and enhance supply chain efficiency. The market appears moderately fragmented, with key players exerting considerable influence over pricing and service standards. This competitive structure allows for a diverse range of service offerings, catering to various customer needs while fostering innovation across the sector.

In November Michelin (FR) announced a strategic partnership with a leading technology firm to develop an AI-driven tire monitoring system aimed at enhancing predictive maintenance capabilities. This initiative is likely to position Michelin (FR) at the forefront of technological innovation in tire maintenance, potentially reducing downtime for construction equipment and improving overall operational efficiency. Such advancements may also align with the growing trend towards data-driven decision-making in the industry.

In October Goodyear (US) launched a new line of eco-friendly tires specifically designed for construction equipment, which utilize sustainable materials and manufacturing processes. This move not only addresses the increasing regulatory pressures for sustainability but also caters to a market segment that is becoming more environmentally conscious. The introduction of these tires could enhance Goodyear's (US) market share while reinforcing its commitment to sustainable practices.

In December Bridgestone (JP) unveiled a comprehensive digital platform that integrates tire management solutions with real-time analytics for construction companies. This platform is expected to streamline operations and provide actionable insights, thereby enhancing customer satisfaction and loyalty. By leveraging digital tools, Bridgestone (JP) is likely to strengthen its competitive edge in a market that increasingly values technological solutions.

As of December current competitive trends indicate a pronounced shift towards digitalization, sustainability, and AI integration within the Construction Equipment Tire Repair and Maintenance Services Market. Strategic alliances are becoming pivotal in shaping the landscape, as companies collaborate to enhance their technological capabilities and service offerings. Looking ahead, competitive differentiation is expected to evolve from traditional price-based competition to a focus on innovation, technology, and supply chain reliability, underscoring the importance of adaptability in a rapidly changing market.