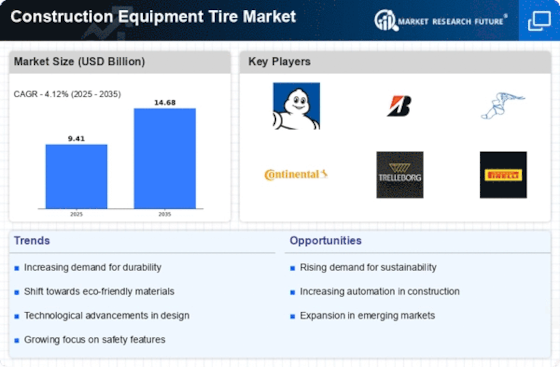

Rising Construction Activities

The Construction Equipment Tire Market is experiencing a surge in demand due to increasing construction activities across various sectors. Infrastructure development, residential projects, and commercial construction are driving the need for robust construction equipment. According to recent data, the construction sector is projected to grow at a compound annual growth rate of approximately 5.5% over the next few years. This growth is likely to result in heightened demand for construction equipment, subsequently boosting the tire market. As construction companies seek to enhance productivity and efficiency, the need for high-quality tires that can withstand challenging terrains becomes paramount. Consequently, manufacturers are focusing on producing durable and reliable tires tailored for diverse construction applications.

Expansion of Rental Equipment Market

The Construction Equipment Tire Market is also being shaped by the expansion of the rental equipment market. As construction companies increasingly opt for rental solutions to manage costs and enhance flexibility, the demand for tires that can withstand varied usage patterns is on the rise. The rental market for construction equipment is projected to grow at a compound annual growth rate of approximately 4.5%. This trend indicates a shift in how construction firms approach equipment acquisition, leading to a need for high-quality tires that can endure frequent use and diverse operating conditions. Rental companies are likely to prioritize durable and reliable tire options to meet the demands of their clients, thereby driving growth in the construction equipment tire market.

Increasing Demand for Off-Road Equipment

The Construction Equipment Tire Market is significantly influenced by the rising demand for off-road equipment. As construction projects often take place in rugged and uneven terrains, the need for specialized tires that can perform under such conditions is paramount. The off-road segment, which includes equipment like bulldozers, excavators, and loaders, is projected to grow steadily, driven by infrastructure projects and mining activities. Data indicates that the off-road equipment market is expected to expand at a rate of around 6% annually. This growth is likely to result in increased tire sales, as construction companies prioritize tires that offer durability, traction, and stability in challenging environments. Consequently, manufacturers are focusing on developing tires specifically designed for off-road applications.

Technological Innovations in Tire Manufacturing

Technological advancements in tire manufacturing are significantly influencing the Construction Equipment Tire Market. Innovations such as advanced rubber compounds, improved tread designs, and enhanced manufacturing processes are leading to the production of tires that offer better performance and longevity. For instance, the introduction of radial tires has revolutionized the market by providing superior traction and reduced rolling resistance. Furthermore, the integration of smart technologies in tire design, such as sensors for monitoring tire pressure and temperature, is becoming increasingly prevalent. These innovations not only improve safety and efficiency but also contribute to cost savings for construction companies. As a result, the demand for technologically advanced tires is expected to rise, further propelling the growth of the construction equipment tire market.

Focus on Sustainability and Eco-Friendly Solutions

The Construction Equipment Tire Market is witnessing a growing emphasis on sustainability and eco-friendly solutions. As environmental concerns become more pronounced, construction companies are increasingly seeking tires that minimize their ecological footprint. This trend is reflected in the development of tires made from sustainable materials and those designed for fuel efficiency. For example, tires that reduce rolling resistance can lead to lower fuel consumption, aligning with the industry's sustainability goals. Additionally, manufacturers are exploring recycling initiatives for used tires, which not only addresses waste management issues but also appeals to environmentally conscious consumers. This shift towards sustainable practices is likely to drive demand for innovative tire solutions in the construction sector.