Market Trends

Key Emerging Trends in the Connected Motorcycle Market

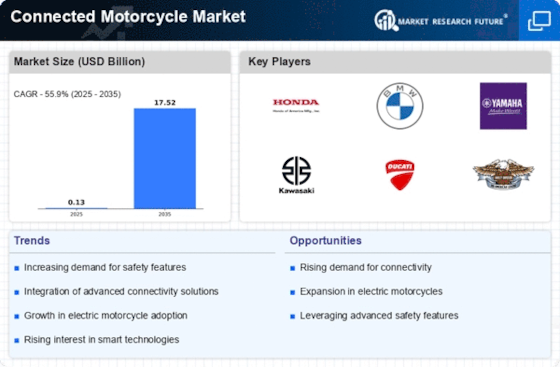

In recent years, the automotive industry has witnessed a significant shift towards connectivity, and motorcycles are no exception. The market trends of connected motorcycles have been on a steady rise, driven by technological advancements and the increasing demand for enhanced safety, convenience, and entertainment features in two-wheelers.

One prominent aspect of the market trend is the integration of smart connectivity solutions. Modern motorcycles are now equipped with advanced systems that enable riders to connect their smartphones seamlessly. This connectivity allows riders to access a range of features, including navigation, music, and communication, all displayed on the motorcycle's dashboard. This integration not only enhances the overall riding experience but also contributes to improved safety by minimizing distractions through hands-free operation.

Safety has become a paramount concern for riders, leading to the incorporation of innovative technologies in connected motorcycles. Anti-lock braking systems (ABS), traction control, and stability control are becoming standard features, offering riders a safer and more controlled riding experience. Additionally, connected motorcycles often come with real-time monitoring and alert systems, notifying riders of potential hazards, maintenance requirements, or even unauthorized access to their bikes.

The rise of Internet of Things (IoT) technology has played a pivotal role in shaping the market trends of connected motorcycles. With sensors and actuators embedded in various parts of the motorcycle, data can be collected and analyzed in real-time. This data-driven approach enables predictive maintenance, allowing riders and service centers to address potential issues before they escalate. Manufacturers can also gather valuable insights into user behavior, leading to continuous improvements in design and functionality.

Another notable trend is the emergence of connected motorcycle ecosystems. These ecosystems involve collaborations between motorcycle manufacturers, technology companies, and service providers to create a seamless and integrated experience for riders. From ride-sharing and parking solutions to personalized insurance plans, these ecosystems aim to cater to the diverse needs of riders while fostering a sense of community within the motorcycle culture.

The concept of Vehicle-to-Everything (V2X) communication is gaining traction in the connected motorcycle market. This technology enables motorcycles to communicate with other vehicles, infrastructure, and even pedestrians, enhancing overall road safety. V2X communication allows for real-time sharing of information about road conditions, traffic, and potential hazards, creating a connected and cooperative environment on the roads.

Environmental consciousness is also influencing market trends in the motorcycle industry. Connected motorcycles are increasingly being designed with eco-friendly features, such as energy-efficient electric powertrains and smart energy management systems. These innovations align with the global push towards sustainability and contribute to reducing the environmental impact of two-wheeled transportation.

The market trends of connected motorcycles reflect a dynamic landscape shaped by technological advancements, safety priorities, and changing consumer preferences. As the industry continues to evolve, we can expect further integration of smart technologies, enhanced safety features, and collaborative ecosystems, ultimately transforming the way riders experience and interact with their motorcycles. The future of connected motorcycles holds exciting possibilities as innovation continues to drive this evolving sector.

Leave a Comment