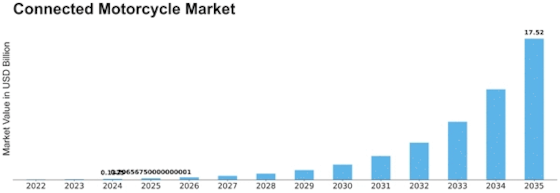

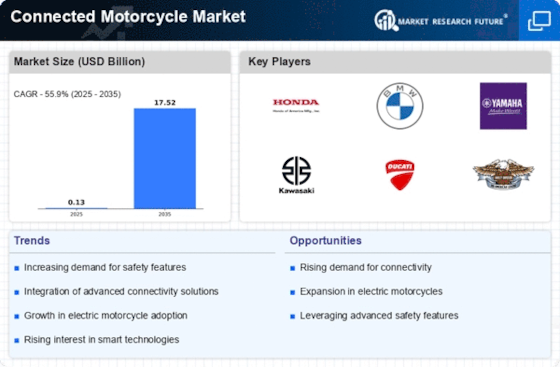

Connected Motorcycle Size

Connected Motorcycle Market Growth Projections and Opportunities

The market factors influencing connected motorcycles reflect a blend of technological advancements, safety considerations, consumer preferences, regulatory standards, and industry trends within the motorcycle industry. One significant factor is the rapid integration of smart and connected technologies into motorcycles, contributing to the emergence of connected motorcycles. These technologies include embedded sensors, GPS navigation, wireless connectivity, and smartphone integration, providing riders with real-time information, enhanced safety features, and connectivity on the road.

Safety considerations play a pivotal role in the market dynamics of connected motorcycles. Connected features, such as collision warning systems, blind-spot detection, and adaptive cruise control, contribute to overall rider safety. Manufacturers and riders alike prioritize technologies that enhance situational awareness, reduce the risk of accidents, and provide emergency assistance when needed. As safety standards and rider expectations evolve, the incorporation of connected features becomes integral to shaping the market for motorcycles.

Technological advancements are key drivers in the market factors of connected motorcycles. The development of advanced telematics systems, Internet of Things (IoT) connectivity, and artificial intelligence (AI) applications enables motorcycles to offer a range of smart features. These may include real-time traffic updates, weather information, and the ability to connect with other smart devices. The continuous evolution of these technologies influences the market dynamics, with manufacturers striving to stay at the forefront of innovation in the connected motorcycle segment.

Consumer preferences for seamless connectivity and enhanced riding experiences contribute to the market factors of connected motorcycles. Riders increasingly seek motorcycles that offer integration with smartphones, allowing for hands-free communication, music streaming, and navigation. The demand for intuitive user interfaces, touchscreens, and voice controls reflects consumer expectations for a connected and user-friendly riding experience. Manufacturers must align their offerings with these preferences to remain competitive in the connected motorcycle market.

Regulatory standards and compliance with safety regulations impact the market dynamics of connected motorcycles. Governments and regulatory bodies are increasingly recognizing the potential of connected technologies to improve road safety. As a result, standards related to vehicle-to-vehicle communication, emergency calling systems, and cybersecurity measures are becoming more prevalent. Manufacturers must ensure that their connected motorcycles comply with these standards, influencing the design, development, and market positioning of their products.

Economic factors, including the cost of connected technologies and affordability for consumers, shape the market for connected motorcycles. The integration of sophisticated connectivity features can contribute to the overall cost of motorcycles. Manufacturers must strike a balance between offering advanced features and maintaining affordability to appeal to a broad consumer base. Pricing strategies, cost-effective technologies, and the value proposition of connected features influence the market acceptance of connected motorcycles.

Environmental considerations and sustainability are emerging as noteworthy market factors for connected motorcycles. As the automotive industry places increased emphasis on eco-friendly practices, manufacturers are exploring ways to integrate connected technologies that contribute to sustainable mobility. Connected features, such as route optimization for fuel efficiency and emission monitoring, align with environmental consciousness and influence consumer choices in the market for connected motorcycles.

The evolving landscape of mobility services and urban transportation trends also impacts the market factors of connected motorcycles. Manufacturers are exploring ways to integrate connected motorcycles into broader transportation ecosystems, including shared mobility services and smart city initiatives. Connectivity features that enable remote diagnostics, maintenance alerts, and seamless integration with urban infrastructure contribute to the adaptability of connected motorcycles within evolving mobility paradigms.

The market factors of connected motorcycles are driven by a combination of technological advancements, safety considerations, consumer preferences, regulatory standards, economic factors, environmental considerations, and urban mobility trends. As the motorcycle industry embraces connectivity and smart technologies, manufacturers must navigate these multifaceted factors to deliver products that meet safety standards, align with consumer expectations, and contribute to the overall evolution of connected and sustainable mobility. The dynamic nature of these market factors underscores the ongoing transformation within the motorcycle industry towards a connected and tech-savvy future.

Leave a Comment