Growing Aging Population

The Global Connected Medical Devices Market Industry is significantly impacted by the growing aging population, which presents unique healthcare challenges. Older adults often require continuous monitoring and management of chronic conditions, making connected medical devices essential for effective care. Devices such as remote monitoring systems and telehealth solutions cater specifically to this demographic, enabling healthcare providers to deliver timely interventions. As the global population ages, the demand for these technologies is expected to rise, contributing to the market's growth trajectory. This demographic shift underscores the necessity for innovative solutions that address the healthcare needs of an increasingly elderly population.

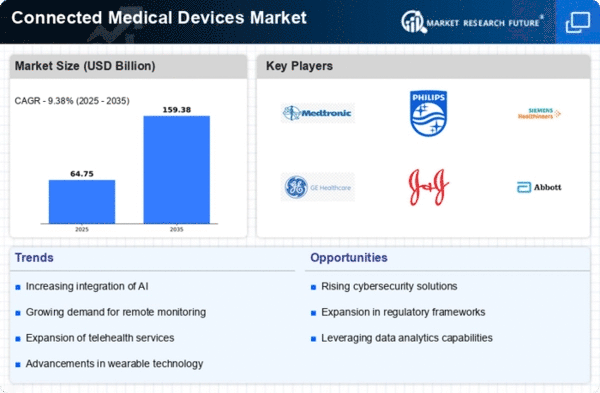

Market Growth Projections

The Global Connected Medical Devices Market Industry is poised for substantial growth, with projections indicating a market size of 1.64 USD Billion in 2024 and an anticipated increase to 6.77 USD Billion by 2035. This growth trajectory reflects a compound annual growth rate of 13.74% from 2025 to 2035. The expansion is driven by various factors, including technological advancements, increasing healthcare costs, and a heightened focus on preventive care. As the industry evolves, stakeholders must adapt to emerging trends and consumer demands to capitalize on the opportunities presented by this dynamic market.

Regulatory Support and Standardization

Regulatory frameworks and standardization efforts significantly influence the Global Connected Medical Devices Market Industry. Governments and health authorities are increasingly recognizing the potential of connected devices in improving healthcare delivery. Initiatives aimed at establishing clear guidelines for device development and data security foster innovation while ensuring patient safety. For example, the FDA has introduced streamlined approval processes for digital health technologies, encouraging manufacturers to bring new solutions to market. This supportive regulatory environment is expected to facilitate market expansion, as it enhances consumer confidence and encourages investment in connected medical technologies.

Increasing Focus on Preventive Healthcare

The Global Connected Medical Devices Market Industry is witnessing a paradigm shift towards preventive healthcare, driven by a growing awareness of health and wellness. This shift encourages individuals to proactively manage their health through connected devices that monitor vital signs and lifestyle factors. For instance, fitness trackers and smartwatches provide users with insights into their physical activity and health metrics, promoting healthier lifestyles. This trend is likely to contribute to the market's growth, with a projected compound annual growth rate of 13.74% from 2025 to 2035. The emphasis on prevention not only enhances individual health outcomes but also alleviates the burden on healthcare systems.

Rising Demand for Remote Patient Monitoring

The Global Connected Medical Devices Market Industry experiences a notable surge in demand for remote patient monitoring solutions. This trend is primarily driven by the increasing prevalence of chronic diseases, which necessitates continuous health monitoring. For instance, devices such as wearable heart monitors and glucose trackers enable healthcare providers to collect real-time data, facilitating timely interventions. As of 2024, the market is projected to reach 1.64 USD Billion, reflecting a growing acceptance of telehealth solutions. This shift towards remote monitoring not only enhances patient outcomes but also reduces healthcare costs, indicating a transformative change in patient management.

Technological Advancements in Medical Devices

Technological innovation plays a pivotal role in shaping the Global Connected Medical Devices Market Industry. The integration of advanced technologies such as artificial intelligence, machine learning, and the Internet of Things enhances the functionality and efficiency of medical devices. For example, smart inhalers equipped with sensors can track medication usage and provide feedback to patients and healthcare providers. These advancements not only improve patient adherence but also enable personalized treatment plans. As the industry evolves, the market is expected to grow significantly, with projections indicating a rise to 6.77 USD Billion by 2035, underscoring the importance of continuous innovation.