Concrete Fiber Size

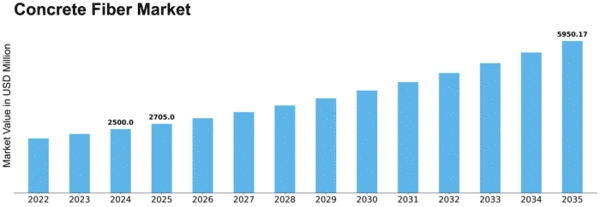

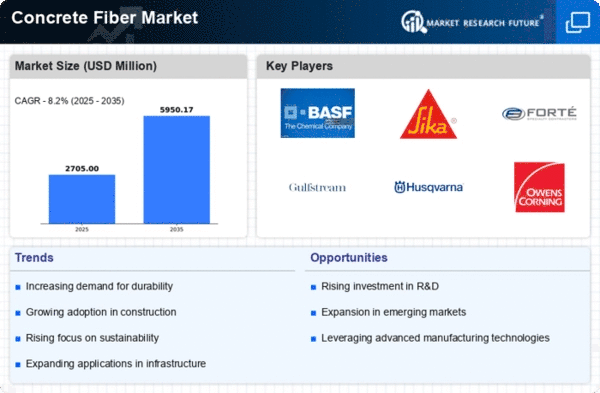

Concrete Fiber Market Growth Projections and Opportunities

The Concrete Fiber Market is a highly important segment of the building materials industry, and many market factors influence its growth and development. Building industry health relates closely to concrete fiber consumption. It is a vital sector. Residential, commercial and infrastructure building patterns of development affect it. During building booms, the Concrete Fiber Market see rising demand. The Concrete Fiber Market is affected by such factors as the role of major players, market share distribution and competing strategies. The market is competitive due to price tactics, product improvements and positioning. The Concrete Fiber Market is mainly driven by large infrastructure projects such as highways, bridges, tunnels and airports. Demand for durable, high-performance concrete increases because of governmental infrastructure investments. This in turn leads to the increased use of concrete fiber. Developments in fiber technology determine the market. Innovation in materials include: concrete composed of synthetic, steel and glass fiber. Those manufacturers who provide such technical advances have naturally commercial advantages. The Concrete Fiber Market Is Impacted by Global Urbanization. As more people go into cities, there are naturally many construction projects which require reinforced concrete. In heavily populated metropolitan areas concrete fibers are used to strengthen structures and infrastructure. Construction codes influence the amount of concrete fiber that can be taken in. Only under regulations that specify durable, high-strength materials are fibers added to concrete. These codes are important to manufacturers and contractors. The price of concrete fiber depends on the cost of raw materials, including those used in production. Firms 'cost structures, pricing strategy and competitiveness depend crucially on two factors: the price of polymer resin and that for steel. The pressure for environmental sustainability has altered consumer and industrial preferences. Recycled or bio-based concrete fibers help to promote sustainability. An eco-friendly market signals an increase in demand for environmentally friendly manufacturers. Economic conditions, population growth and culture define patterns of regional construction. To meet the diverse requirements of different markets, firms in this space must know regional building trends and how to customize their products. Concrete durability: Weather and environment. The severe temperatures, freeze-thaw cycles and corrosive environments mean that concrete reinforcement is an absolute necessity. " This helps solve these problems by strengthening concrete buildings with concrete fibers.

Leave a Comment