Market Analysis

In-depth Analysis of Concrete Fiber Market Industry Landscape

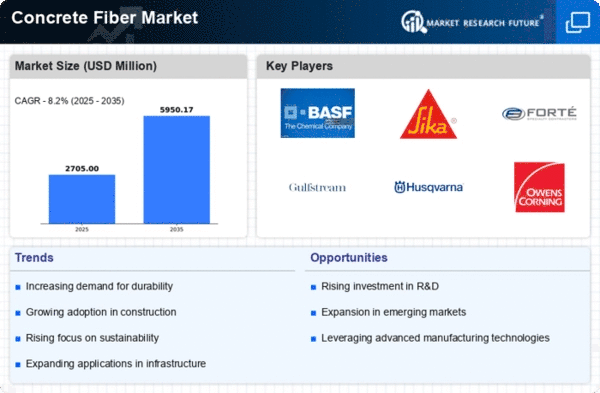

The Concrete Fiber Market is an ever-changing and growing industry that contributes to improving the strength and longevity of concrete structures. Stakeholders need a clear picture of the market dynamics in order to make informed choices and not miss out on new possibilities. Here's an overview in a paragraph with a pointer format: The global construction industry exerts a heavy influence on the market dynamics of concrete fiber. With urbanization and infrastucture development rising, the need for concrete--as well as more advanced versions like fiber-reinforced concrete--has also risen. Residential, commercial and industrial projects together power the expanding construction sector, which in turn directly affects concrete fiber demand. Concrete fibers the market provides include synthetic, steel, glass and natural. Different types have different properties and applications, meeting all kinds of construction needs. For both manufacturers and end-users the characteristics of these fibers are important in being able to choose the proper one for specific projects. The use of concrete fibers to improve the quality of a structure is well known. They increase tensile strength, crack resistance and durability. Such improvements make them valuable additions to construction materials. The dynamics of the market come down to high-performance concrete solutions which must be strong enough for modern construction projects. The market for concrete fiber is also very dynamic, due to continuing R & D efforts in the field of fiber technology. With innovations in manufacturing processes, material composition and fiber geometry come advanced fibers with superior performance characteristics. Those who make investments in research and accept technological advancements enjoy a competitive advantage. Most importantly, regulations and standards governing construction materials oversee the concrete fiber market. These standards must be observed, for market participants to win the builders 'and regulatory authorities' approval and trust. Regulatory change affects market firmament, influencing manufacturing habit as well as product features. In today's environment of sustainability the concrete fiber market is turning towards greener, more ecological and sustainable methods. The manufacturers are creating fibers from recycled materials, and more end-users want green building. These market dynamics are heavily influenced by sustainability considerations including reduced environmental impact and energy efficiency. Because construction methods, climate conditions and infrastructure development vary between regions, demand for concrete fibers diff-er.

Leave a Comment