Emergence of Industry 4.0

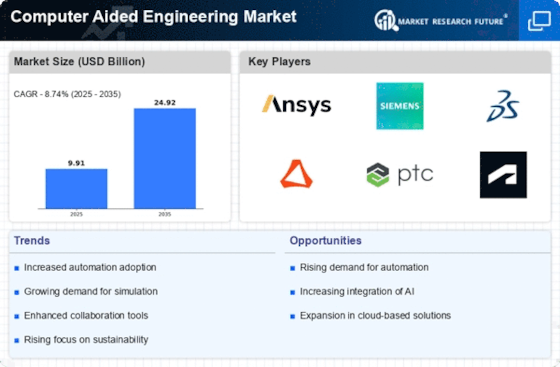

The emergence of Industry 4.0 is reshaping the Computer Aided Engineering Market. This paradigm shift towards smart manufacturing and automation is driving the adoption of advanced engineering tools that facilitate real-time data analysis and decision-making. As industries increasingly embrace IoT and interconnected systems, the demand for computer aided engineering solutions that can integrate with these technologies is on the rise. The market for Industry 4.0-related engineering tools is projected to grow significantly, with estimates suggesting a growth rate of around 12% annually. This transformation not only enhances operational efficiency but also fosters innovation, positioning the Computer Aided Engineering Market at the forefront of technological advancement.

Rising Demand for Simulation Tools

The Computer Aided Engineering Market experiences a notable increase in demand for simulation tools. Industries such as automotive, aerospace, and manufacturing are increasingly adopting these tools to enhance product design and performance. The market for simulation software is projected to grow at a compound annual growth rate of approximately 10% over the next five years. This growth is driven by the need for accurate modeling and analysis, which allows companies to reduce development time and costs. As organizations strive for innovation, the integration of advanced simulation tools becomes essential. Consequently, the Computer Aided Engineering Market is likely to witness a surge in investments aimed at developing more sophisticated simulation capabilities.

Advancements in Computational Power

Advancements in computational power significantly influence the Computer Aided Engineering Market. The continuous evolution of hardware technologies, such as multi-core processors and high-performance computing systems, enables engineers to perform complex simulations and analyses more efficiently. This enhancement in computational capabilities allows for the handling of larger datasets and more intricate models, which is crucial for industries like aerospace and energy. As a result, the market for computer aided engineering tools is expected to expand, with a projected growth rate of around 8% annually. The ability to conduct real-time simulations and analyses positions organizations to make informed decisions swiftly, thereby driving the Computer Aided Engineering Market forward.

Growing Need for Regulatory Compliance

The Computer Aided Engineering Market is significantly impacted by the growing need for regulatory compliance across various sectors. Industries such as pharmaceuticals, automotive, and aerospace are subject to stringent regulations that necessitate thorough testing and validation of products. As a result, there is an increasing reliance on computer aided engineering tools to ensure compliance with safety and quality standards. The market for compliance-related engineering solutions is expected to grow at a rate of approximately 7% per year. This trend underscores the importance of integrating compliance checks within the engineering process, thereby enhancing product reliability and safety. Consequently, the Computer Aided Engineering Market is likely to see a rise in demand for tools that facilitate regulatory adherence.

Increased Focus on Product Lifecycle Management

The Computer Aided Engineering Market is witnessing an increased focus on product lifecycle management (PLM). Companies are recognizing the importance of integrating engineering processes with PLM systems to enhance collaboration and efficiency. This trend is particularly evident in sectors such as consumer electronics and automotive, where the need for rapid product development is paramount. The PLM market is anticipated to grow at a rate of approximately 9% per year, reflecting the growing demand for tools that facilitate seamless integration of design, engineering, and manufacturing processes. By leveraging PLM solutions, organizations can optimize their workflows, reduce time-to-market, and improve overall product quality, thereby propelling the Computer Aided Engineering Market.